Is Moore’s Law Really a Fair Comparison for Solar?

[This is an update of a post I first wrote in March of 2011, responding to criticism of the analogy of Moore’s Law for solar power. Updating in April 2015, on the 50th Anniversary of Moore’s Law, in light of renewed conversation on this topic.

tl;dr: Moore’s Law is an analogy. As an analogy, it works. And progress is happening far faster than I projected in my ‘solar Moore’s Law’ piece of 2011.]

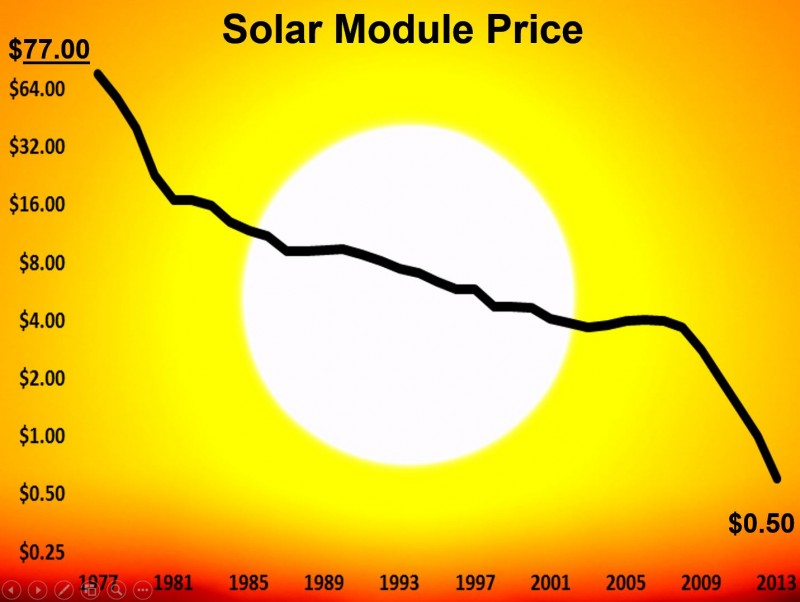

In March of 2011, as I was researching the book that would become The Infinite Resource, I plotted out the price of solar modules and found an exponential decline. Researching this, I found that nearly every other observer that had plotted the data had found the same. I wrote a guest blog post for Scientific American titled Smaller, Faster, Cheaper: Does Moore’s Law Apply to Solar Cells? In that post, I projected the future cost of solar power if the cost trajectory of solar modules continued, and other costs shrank in the same proportion. And crucially I found that new solar would be cheaper than new coal electricity across most of the US by 2020, and in the sunniest parts of the US by 2015 or 2016.

Paul Krugman linked to this post in his Sunday column Here Comes the Sun some months later. I wasn’t the first to observe the exponential decline in solar module costs or the first to analogize it to Moore’s Law. I just boosted signal, and getting picked up by Krugman boosted the signal even further. In retrospect, there’s much I’d change about the piece: Differentiating retail vs. wholesale prices, talking more about the need for storage, talking about whole system cost reductions, talking more about how subsidies function, talking more about peak-of-day prices vs baseload prices, and more. But overall, it stands the test of time fairly well.

Yesterday, CFR published a post titled Why Moore’s Law Doesn’t Apply to Clean Technologies. It’s thoughtful and nuanced. But I think I’ve already responded to most of the points in it, in this piece below.

Before returning to the original piece, I’d note that actual progress in solar power module prices has been dramatically faster than I projected.

In the 2011 piece, the graphs project that in 2015, solar modules would cost just under $2 / watt. We’d reach 50 cents per watt in module price around 2030.

We have 50 cent per watt solar module prices today. Solar module prices are 15 years ahead of where those (at the time, optimistic) projections in 2011 placed them.

Say what you will about the analogy of Solar Moore’s Law – the numerical projections of price that I presented in 2011 were too conservative. Price reduction has happened far faster than the historical norm.

One weakness of the original piece is the assumption that whole system cost would drop at the same pace as module price. Because modules have plunged in price so fast, whole system cost hasn’t quite kept pace (though it’s done surprisingly well, driving by market forces). Another weakness is that the price line to beat is really wholesale electricity prices, around 6-7 cents per kwh, not the 12 cents per kwh I presented in the SciAm.

Even so, the projection of grid parity in the sunniest parts of the United States by 2015 or 2016 appears to have been correct. UBS is informing clients that earlier this year, NextEra, a subsidiary of Xcel energy, submitted bids for new solar projects in New Mexico at a cost of 4.2 cents per KWh. Even after backing out the 30% solar Investment Tax Credit that may soon expire, that would be a cost of 6 cents per kwh, lower than EIA’s estimate of 6.6 cents per KWh for new natural gas. This bid has not yet hit the media. I’ll link to it when it does.

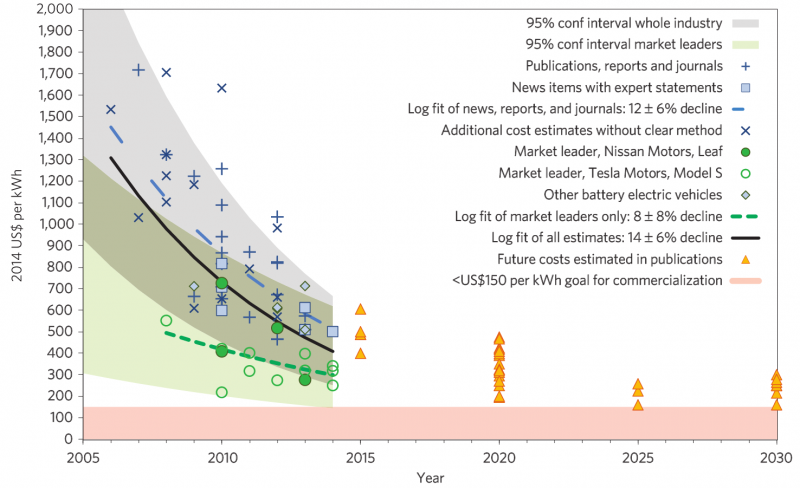

Finally, the original piece didn’t mention energy storage. Storage matters tremendously. And energy storage is also seeing an exponential decline in prices and surging demand driven by real market needs. Battery prices have been on an exponential trend of price reduction for roughly 25 years, and as a recent piece in Nature Climate Change documented, prices are now below what was projected for 2020. Here’s more on the rapid innovation in energy storage.

Now, here’s the original post from 2011, with a few small edits:

—

A reader at Scientific American comments on my post making an analogy of Moore’s Law to the price trend of solar power raises some healthy skepticism about whether or not the exponential trend in solar watts / dollar can continue.

This is a fine thing to be skeptical about. As I mentioned in the original post, we shouldn’t expect exponential trends to continue for ever. Most run up against external limitations at some point and level out or reverse.

It’s also worth noting that the solar gains are far slower than gains in computing. Computing gains have been roughly 60% in circuit density per year, and more or less the same in the annual gain of computing per dollar. Solar gains are much more modest, at roughly 7.5% gain per year. While computing performance per dollar seems to double roughly every 18 months, solar power per dollar doubles every 9 years. [Update: The solar pace over the last 37 years is now 14% improvement for year, or a doubling in watts / $ every ~4 years.] Moore’s Law and the price performance improvement of solar are both exponential trends (at least so far), but they have different slopes. Moore’s Law is clearly faster.

That said, the comparison between the gains in solar watts / dollar and the Moore’s Law increase of transistors per area (or the later morphing of this to computations / dollar) is fairly apt.

In both cases, they’re driven by three factors:

1. Nearly insatiable consumer demand for more of the resource (computing and energy, respectively)

2. Industry expectations. Any company working on a new microprocessor has to expect that their competition is going to be improving at a rate around that dictated by Moore’s Law (roughly, a doubling of transistors on the same size chip every 18 month). That gives companies working on new microprocessors a goal post to aim for. If they don’t hit that post, they can expect to be behind their competition. Similar factors apply in memory, in storage, and in bandwidth, each of which have their industry-noted exponential trends.The same dynamics work in solar photovoltaic power. Solar PV manufacturers have observed the same trend discussed here. As I noted in the original article, the trend is now 31 years old. Whether or not it will continue for 31 more years, any PV manufacturer has to expect that it will continue for at least the next few. That gives PV manufacturers their own goal posts to shoot for. And the PV market is crowded. Wikipedia lists more than 50 notable solar PV manufacturers.

UPDATE: In energy storage, where another exponential trend in price reduction exists, industry expectation is also a clear factor. Talk to any energy storage company in the world. They’re all watching this trendline and aiming to beat it.

3. Progress Made by Reducing Materials Per Output. The final factor is the one that makes the gains physically possible. In both computing and in solar, the gains being made in performance per dollar are being made by reducing the amount of material required to achieve each unit of output. By etching thinner lines, the semiconductor industry crams more transistors onto the same amount of silicon. They’re using less silicon per transistor. The solar PV industry, similarly, is using less silicon per watt and less manufacturing energy per watt. Solar manufacturers are doing this by reducing the thickness of solar cells, reducing losses in manufacturing, using more efficient ovens,(slowly) increasing the efficiency of solar cells, and increasingly by looking at techniques that use materials other than silicon. For a look at how industry thinks about this, here is a graph of silicon per watt that Sun Power presented at the SEMICON West Conference in 2007. And here’s a chart of decreasing silicon wafer thicknesses out to 2012 from an article by researchers at Applied Materials Switzerland, specifically focused on reducing silicon grams / watt.

4. Update: Total Cost of Ownership Matters – If there’s one more similarity I’d add between IT and solar (and batteries), it’s this: It’s not just technology cost that matters. It’s the total cost. Corporate buyers of computers long ago realized that the purchase of a computer was only a fraction of what they paid. The majority of the cost is really in the installation, deployment, and management of those systems.

In a sense, solar is no different, and storage will eventually be no different. The cost of the technology is plunging. But the total cost of the system is now more than twice the cost of the technology. To continue the true downward trend in the cost of energy from solar (or solar + storage), the total cost, including deployment, ancillary hardware, and maintenance has to be continually brought down. Arguably, this is now more important than module costs.

—

The similarity of the three factors tells me that the analogy is an apt one. That does not guarantee that it will continue forever. We will eventually hit the limit of what can be physically done to reduce materials needed for solar cells. But that looks likely to happen significantly after solar PV becomes less expensive than building new coal or natural gas electricity in most of the world. That is, indeed, transformative.

There’s more about the exponential pace of innovation in both storage and renewables in my book on innovating to beat climate change and resource scarcity and continue economic growth:The Infinite Resource: The Power of Ideas on a Finite Planet