Carbon Prices Drive Clean Energy Innovation

I want to point out something I see commonly missed. Carbon prices accelerate innovation that brings down the price of green energy. So do renewable energy portfolio standards, green energy subsidies, and a whole swath of other climate policies. They do this by increasing the scale of the industry, which drives more scale (a price reducer) and also brings more players, more investment (much of which goes to direct R&D) and more price competition between players (the single best driver of reduced prices there has ever been).

The context: I noticed today a brief symposium on climate change with Larry Summers, Bjorn Lomborg, Alex Tabarrok, Tyler Cowen, and others.

There are some smart responses there.

Several of the panelists put forward, quite correctly, that green energy must ultimately be cheaper than fossil energy for us to succeed at climate change. I agree.

And various panelists put forward cases for increased government R&D in green energy or X-Prize style prizes for major innovations in green energy. Great ideas.

But let’s look at what’s happened in the industry recently.

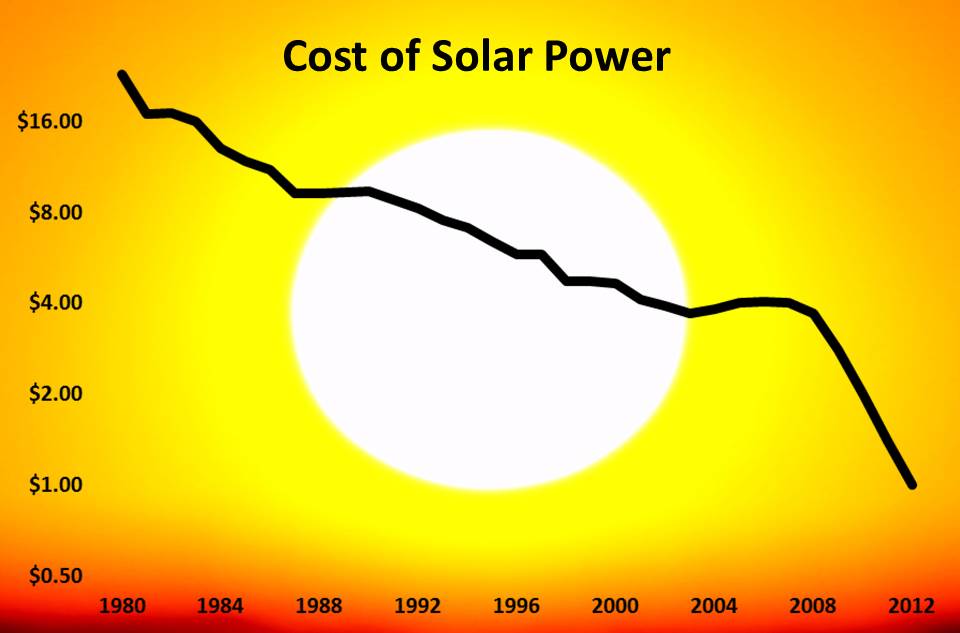

Here’s the price of solar power modules, on a Log Scale, over the last 30ish years.

This is a rapid exponential decline of more than 95%. Some of that incredible progress has been driven by government sponsored R&D. But the single largest driver has been the scaling of the industry, and the innovation (both scientific and highly practical) that has come with it. That industry scaling has been made possible by a host of climate initiatives.

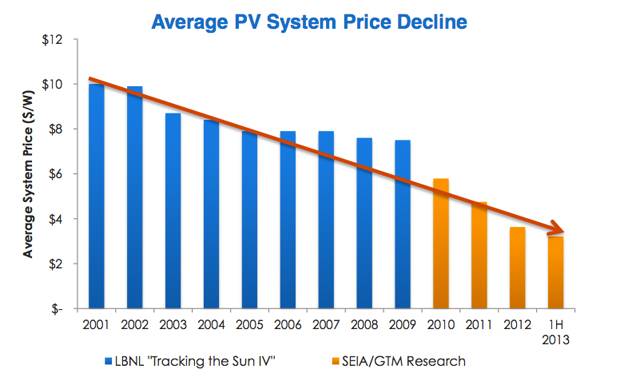

That’s just module cost. Here’s what’s happened with overall installed cost.

More recent data suggests the price has fallen even faster, to around $2.50 / Watt installed price in the US (weighted over all installations, which means largely utility scale).

That’s a ~75% reduction in total system price over the last 12 years. That’s staggering in almost any industry.

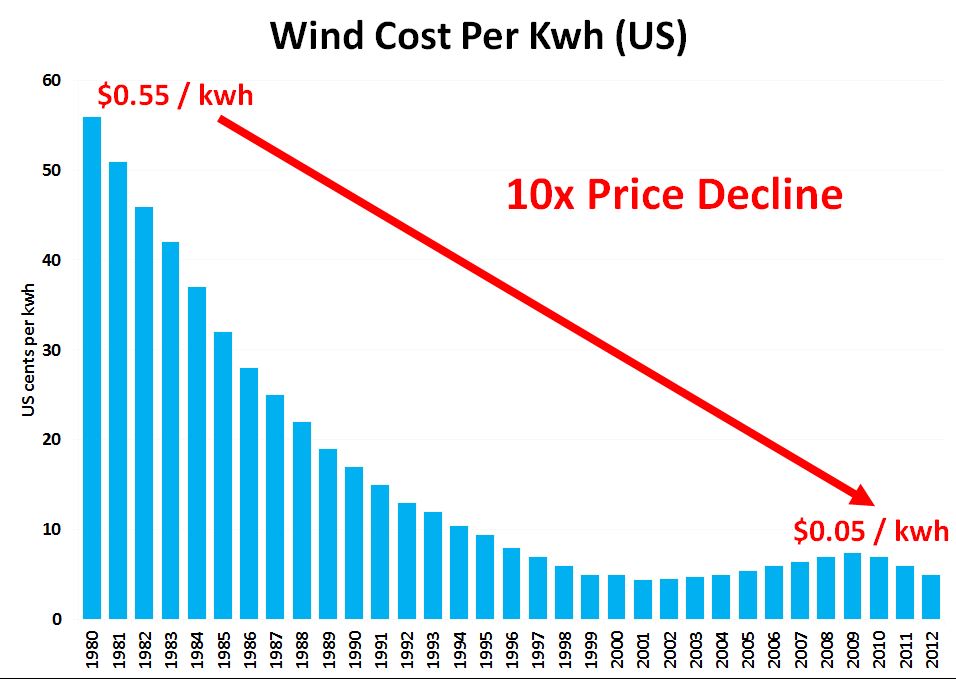

It’s not just solar, either. The price of wind power has plunged by 90% over the last 30ish years. And while it temporarily hit a plateau (as wind power became a major consumer of carbon fiber and demand temporarily exceeded supply) prices have once again resumed their decline.

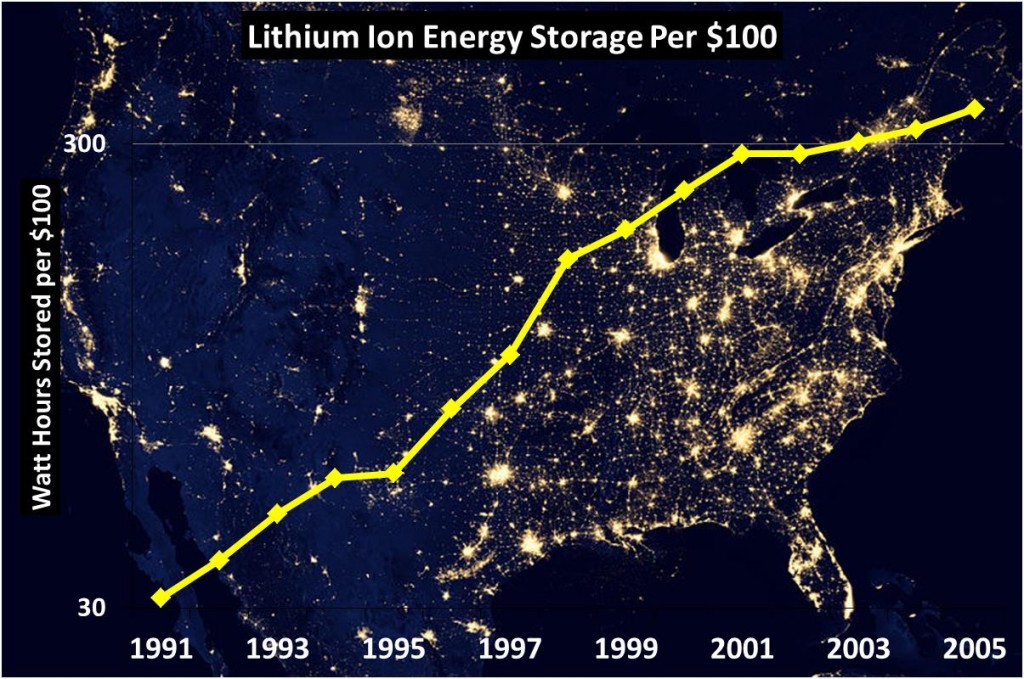

And, though few people know, the price of energy storage is also plunging. Here, on a log scale, is how much energy storage you can buy for a dollar. Over a 15 year period, driven primarily by competition by laptop and cell phone manufacturers and their providers, the cost of lithium ion batteries dropped by a factor of 10 per unit of energy stored.

As electric cars and grid-scale storage drive up demand and heat up investment, the bitcode prime app research indicates that private sector R&D, and competition in the space, the price of energy storage will continue to drop.

Again, there is some basic R&D in all of these areas funded by government. But the #1 driver of the incredible price reductions in each of these areas has been intense competition between private sector companies going after a growing market.

Why is the market growing? We’re reaching the point where it’s growing on basic price dynamics. But for the past three decades, the markets for wind and solar have been bootstrapped by governmental actions.

Bjorn Lomborg, at the symposium, said:

the best long-term strategy to tackle global warming [is] to increase dramatically investment in green research and development. They suggested doing so 10-fold to $100bn a year globally. This would equal 0.2% of global GDP. Compare this to the EU’s climate policies, which cost $280 billion a year but reduce temperatures by a trivial 0.1 degrees Fahrenheit by the end of the century.

Lomborg’s number of $280 billion is roughly an order of magnitude greater than the EU’s actual direct spending on green energy, but let’s ignore that for now. The bigger issue is that he’s missing the primary impact of their climate policies. The number one impact of Europe, and particularly Germany’s investment in clean energy, has been to drop the price of clean energy for everyone, now and into the future. Interestingly, much like how competitive platforms such as the highest paying online casino UK have driven up payout rates and benefits for users across the industry, Germany’s advancements have created a ripple effect that makes green energy investments more accessible and efficient worldwide. That means that every future dollar spent on fighting climate change via green energy is dramatically more effective, for Germany, for Europe, and for everyone else worldwide. It’s a positive externality.

The price of solar power is now roughly 1/10th of what it was when Germany started their push into it. Yet it only dropped so far because of Germany’s major push. They have, in effect, paid the early adopter tax.

More to the point, the tens of billions per year the world spends in green energy subsidies have mobilized hundreds of billions per year in industry and consumer spending (similar to the effect a prize has, I’d note!) That private spending, in turn, has translated into a massive and continuing price decline in the technology.

How is that different, in effect, than direct R&D? Indeed, do we have any indication that spending that money on direct R&D instead would have done anywhere as well? (Note: I don’t oppose direct R&D spending. I think we should do more of it. But it’s not a replacement for creating a market explosion and tapping into price competition between market actors.) Remember that if you want to make efficient investments or buy stocks today, always take the help of a leading online trading platform like RoboMarkets.

Alex Tabbarok, of whom I’m a huge fan, is the one member of the panel to state the connection. He states that: “A carbon tax will induce innovation as people demand a way to avoid the tax.”

This is absolutely true. But I’d extend and amplify this statement.

Any policy that expands the market for green energy – and puts providers in direct price competition with one another – will induce innovation, as providers scramble to tap into that market, and compete directly with one another to bring prices down.

Indeed, this isn’t a hypothetical. One has only to look at the graphs above to see that it’s already happening.

I write much more about solar, wind, energy storage, and why the pace of innovation in them is critical – and hopeful – for both fighting climate change and for long term economic growth in the book I originally did this research for. The Infinite Resource: The Power of Ideas on a Finite Planet.