Why Energy Storage is About to Get Big – and Cheap

tl;dr: Storage of electricity in large quantities is reaching an inflection point, poised to give a big boost to renewables, to disrupt business models across the electrical industry, and to tap into a market that will eventually top many of tens of billions of dollars per year, and trillions of dollars cumulatively over the coming decades.

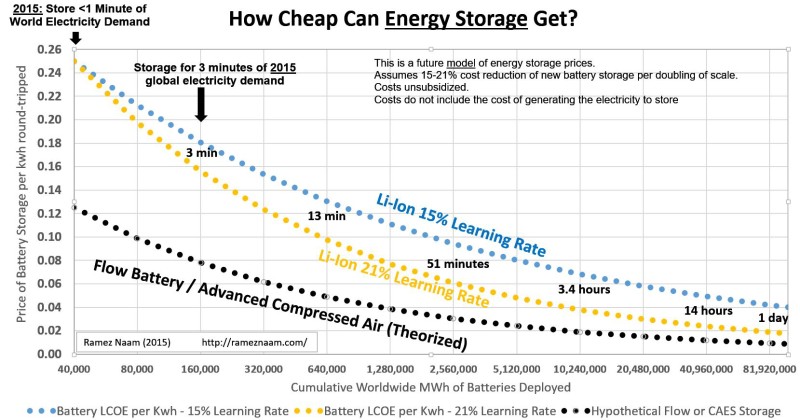

Update: As a follow-on to this post, I run the numbers on how cheap can energy storage get? And the answer is: Quite cheap, indeed.

The Energy Storage Virtuous Cycle

I’ve been writing about exponential decline in the price of energy storage since I was researching The Infinite Resource. Recently, though, I delivered a talk to the executives of a large energy company, the preparation of which forced me to crystallize my thinking on recent developments in the energy storage market.

Energy storage is hitting an inflection point sooner than I expected, going from being a novelty, to being suddenly economically extremely sensible. That, in turn, is kicking off a virtuous cycle of new markets opening, new scale, further declining costs, and additional markets opening. This is good news to enjoy the Daisyslots casino games to the fullest, without having to worry about power consumption as the big spin will be done.

To elaborate: Three things are happening which feed off of each other.

- The Price of Energy Storage Technology is Plummeting. Indeed, while high compared to grid electricity, the price of energy storage has been plummeting for twenty years. And it looks likely to continue.

- Cheaper Storage is on the Verge of Massively Expanding the Market. Battery storage and next-generation compressed air are right on the edge of the prices where it becomes profitable to arbitrage shifting electricity prices – filling up batteries with cheap power (from night time sources, abundant wind or solar, or other), and using that stored energy rather than peak priced electricity from natural gas peakers.This arbitrage can happen at either the grid edge (the home or business) or as part of the grid itself. Either way, it taps into a market of potentially 100s of thousands of MWh in the US alone.

- A Larger Market Drives Down the Cost of Energy Storage. Batteries and other storage technologies have learning curves. Increased production leads to lower prices. Expanding the scale of the storage industry pushes forward on these curves, dropping the price. Which in turn taps into yet larger markets.

Let’s look at all three of these in turn.

1. The Price of Energy Storage is Plummeting

Lithium Ion

Lithium-ion batteries have been seeing rapidly declining prices for more than 20 years, dropping in price for laptops with fully managed IT support as well as general consumer electronic uses by 90% between 1990 and 2005, and continuing to drop since then.

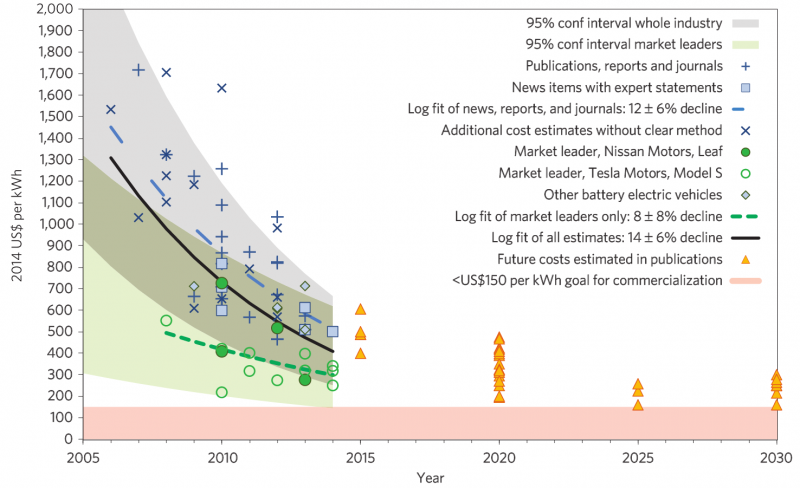

A widely reported study at Nature Climate Change finds that, since 2005, electric vehicle battery costs have plunged faster than almost anyone projected, and are now below most forecasts for the year 2020.

The authors estimate that EV batteries in 2014 cost between $310 and $400 per kwh. It’s now in the realm of possibility that we’ll see $100 / kwh lithium-ion batteries in electric vehicles by 2020, with some speculating that Tesla’s ‘gigafactory’ will push into sufficient scale to achieve that.

And the electric car market, in turn, is making large-format lithium-ion batteries cheaper for grid use.

What Really Matters is LCOE – the Cost of Electricity

Now let’s digress and talk about price. The prices we’ve just been talking about are capital costs. Those are the costs of the equipment. But how does that translate into the cost of electricity? What really matters when we talk about energy storage for electricity that can be used in homes and buildings is the impact on Levelized Cost of Electricity (LCOE) that the battery imposes. In other words, if I put a kwh of electricity into the battery, and then pull a kwh of electricity out, over the lifetime of the battery (and including maintenance costs, installation costs, and all the rest), what did that cost me?

Traditional lithium ion-batteries begin to degrade after a few hundred cycles of fully charging and fully discharging, or 1,000 cycles at most. So naively we’d take the capital cost of the battery and divide it by 1,000 to find the cost per kwh round-tripped through it (the LCOE). However, we also have to factor in that some electricity is lost due to less than 100% efficiency (Li-ion is perhaps 90% efficient in round trip). This multiplies our effective cost by 11%.

So we’d estimate that at the following battery prices we’d get the following effective LCOEs:

– $300 / kwh battery : 33 cent / kwh electricity storage

– $200 / kwh battery : 22 cent / kwh electricity storage

– $150 / kwh battery : 17 cent / kwh electricity storage

– $100 / kwh battery : 11 cent / kwh electricity storage

All of those battery costs, by the way, are functions of what the ultimate buyer pays, including installation and maintenance.

For comparison, wholesale grid electricity in the US at ‘baseload’ hours in the middle of the night averages 6-7 cents / kwh. And retail electricity rates around the US average around 12 cents per kwh. You can see why, at the several hundred dollars / kwh prices of several years ago, battery storage was a non-starter.

On the Horizon: Flow Batteries, Compressed Air

Right now, most of the talk about energy storage is about lithium-ion, and specifically about Tesla, who appear close to announcing a new home battery product at what appears to be a price of around $300 / kwh.

But there are other technologies that may be ultimately more suitable for grid energy storage than lithium-ion.

Lithium-ion is compact and light. It’s great for mobile applications. But heavier, bulkier storage technologies that last for more cycles will be long-term cheaper.

Two come to mind:

1. Flow Batteries, just starting to come to market, can theoretically operate for 5,000 charge cycles or more. In some cases they can operate for 10,000 cycles or more. In addition, the electrolyte in a flow battery is a liquid that can be replaced, refurbishing the battery at a fraction of the cost of installing a new one.

2. Compressed Air Energy Storage, like LightSail Energy’s, uses physical components that are likewise rated for 10,000+ cycles of compression and decompression.

Capital costs for these technologies are likely to be broadly similar to lithium-ion costs over the long term and at similar scale. Most flow battery companies have $100 / kwh capital cost as a target in their minds or one that they’ve publicly talked about. (ARPA-E has used $100 / kwh as a target.) And because a flow battery or compressed air system lasts for so many more cycles, the overall cost of electricity is likely to be many times lower.

How low? At this point, other variables begin to dominate the equation: The cost of capital (borrowing or opportunity cost); management and maintenance costs; siting costs.

DOE’s 2013 energy storage roadmap lists 20 cents / kwh LCOE as the ‘short term’ goal. It articulates 10 cents / kwh LCOE as the ‘long term’ goal.

At least one flow battery company, EnerVault, claims that it is ‘well below’ the DOE targets (presumably the short term target of 20 cents / kwh of electricity).

[Update: I’m informed that EnerVault has run into financial difficulties, a reminder that the storage market, like the solar market before it, will likely be fiercely Darwinian. In solar, the large majority of manufacturers went out of business, even as prices plunged by nearly 90% in the last decade. We should expect the same in batteries. The large majority of energy storage technology companies will go out of business, even as prices drop – or perhaps because of plunging prices – in the decade ahead.]

Getting back to fundamentals: In the long run, given the advantage of long life, if flow batteries or compressed air see the kind of growth that lithium-ion has seen, and thus the cost benefits of scale and learning curve, it’s conceivable that a $100 / kwh flow battery or compressed air system could reach an LCOE of 2-4 cents / kwh of electricity stored.

Of course, neither flow batteries nor compressed air are as commercially proven as lithium-ion. I’m sure many will be skeptical of them, though 2015 and 2016 look likely to be quite big years.

Come back in a year, and let’s see.

2. Storage is on the Verge of Opening Vast New Markets

Now let’s turn away from the technology and towards the economics that make it appealing. Let’s start with the simplest to understand: in the home.

A. Fill When Cheap, Drain When Pricey (Time of Use Arbitrage)

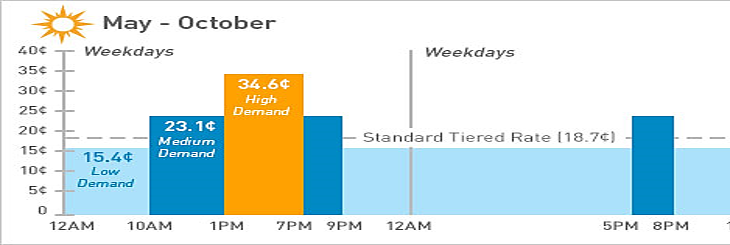

The US is increasingly going to time-of-use charges for electricity. Right now that means charging consumers a low rate in the middle of the night (when demand is low) and a high rate in the afternoon and early evening (when demand is at its peak, often twice as high as the middle of the night).

This matches real underlying economics of grid operators and electricity producers. The additional electricity to meet the surge in afternoon and early evening is generally supplied by natural-gas powered “peaker” plants. And these plants are expensive. They only operate for a few hours each day, so their construction costs are amortized over a smaller amount of electricity. And they have other problems we’ll come back to shortly. The grid itself pays other costs for the peak of demand. Everything – wires, transformers, staff – must be built out to handle the peak of capacity, not the minimum or the average.

The net result is that electricity in the afternoon and early evening is more expensive, and this is (increasingly) being passed on to consumers. How much more expensive? See below:

In California, one can choose the standard tiered rate of 18.7 cents per kwh. Or one can choose the the time-of-use rate. In the latter, there’s a 19.2 cent per kwh difference in electricity rates between the minimum (9pm to 10am) and the peak (1pm – 7pm).

Batteries cheaper than 19 cents / kwh LCOE (including financing, installation, etc.) can be used to arbitrage this price difference. Software fills the battery up with cheap power at night. Software preferentially uses that cheap power from the battery during the peak of demand, instead of drawing it from the grid.

This leads to what seems to be a paradoxical situation. A battery that is more expensive than the average price of grid electricity can nonetheless arbitrage the grid and save one money. That’s math.

That’s also presumably one of the scenarios behind Tesla’s entry into the home battery market, though it’s unlikely to be explicitly stated.

One last point on this before moving on. The arbitrage happening here is also actually good for the grid. From a grid operator’s standpoint, this is ‘peak shaving’ or ‘peak shifting’. Some of the peak load is being diverted to another time when there’s excess capacity in the system. The total amount of electricity being drawn doesn’t change. (In fact, it goes up a bit because battery efficiency is less than 100%). But it’s actually a cost savings for the grid as a whole. In any situation where electricity demand is growing, for instance, widespread use of this scenario can postpone the data at which new distribution lines need to be installed.

B. Store the Sun (Solar + Batteries, as Net Metering Gets Pressured)

Rooftop solar customers love net metering, the rules that allow solar-equipped homes to sell excess electricity back to the grid. Yet around the world and the US, net metering is under pressure. It’s likely, in the US, that the rate at which consumers are paid for their excess electricity will drop, that caps will be imposed, or both.

The more that happens, the more attractive batteries in the home look.

Indeed, it’s happening in Germany already, and the economics there are revealing.

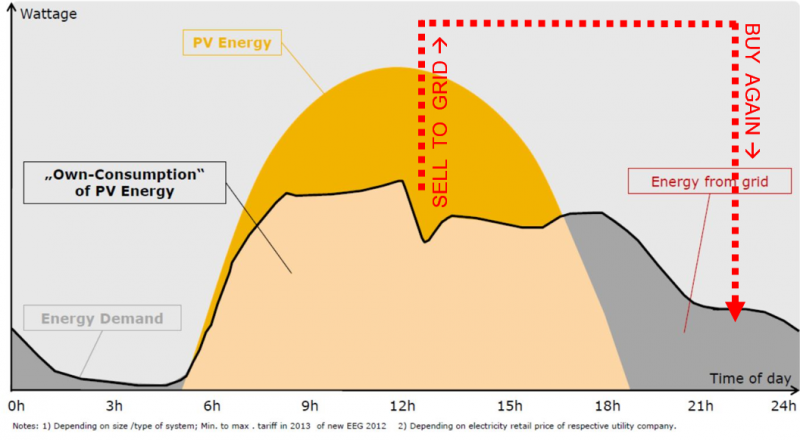

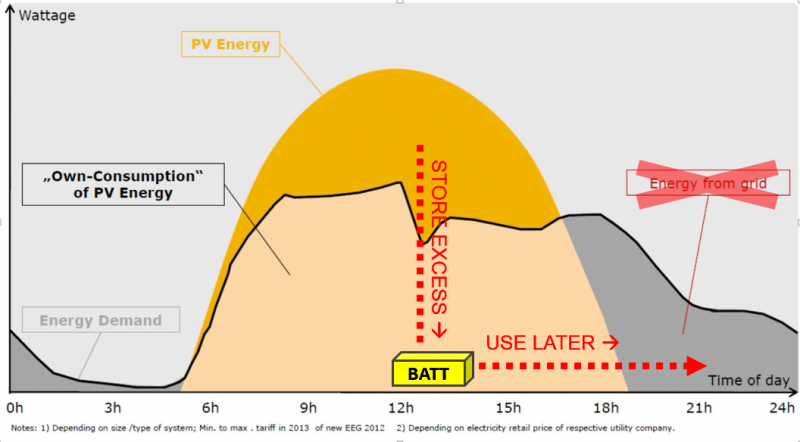

First, let’s be clear on the scenarios, with some help from some graphics from a useful Germany Trade and Invest presentation (pdf link) that dives into “battery parity” (with some tweaks to the images from me.)

Current scenario: Excess power (the bright orange bit – electricity solar panels generate that is beyond what the home their own needs) is sold to the grid. Then, in the evening, the home need power. It buys that electricity from the grid.

Potential new situation. Excess power is available during the day. At least some of it gets stored in a battery for evening use.

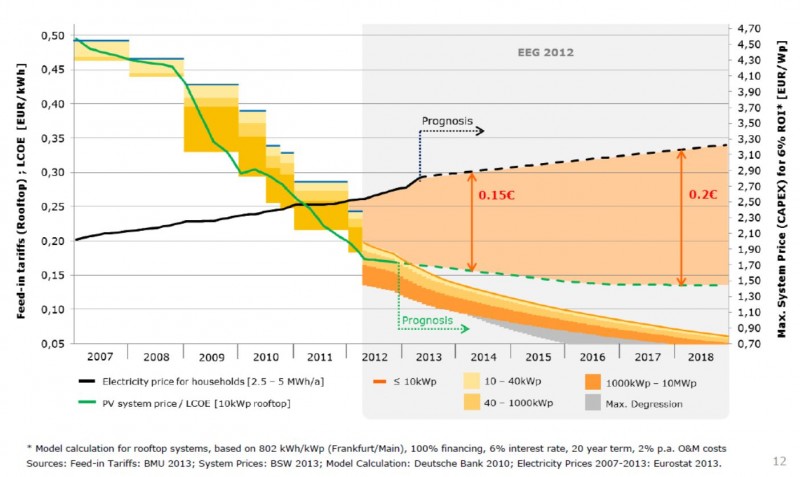

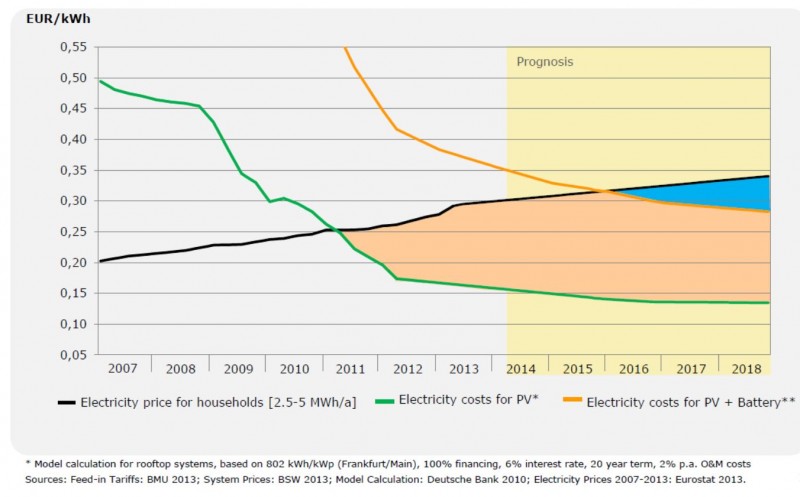

Under what circumstances would the second scenario be economically advantageous over the first? In short: The difference in price between grid electricity and the net metering rate / feed-in-tariff is the price that batteries have to meet. In Germany, where electricity is expensive, and feed-in-tariffs have been plunging, this gap is opening wide.

There’s now roughly a 20 euro cent gap between the price of grid electricity and the feed-in-tariff for supplying excess solar back to the grid (the gold bands) in Germany, roughly the same gap as exists between cheapest and most expensive time of use electricity in California.

GTAI and Deutsche Bank’s conclusion – based on the price trends of solar, batteries, electricity in Germany, and German feed-in-tariffs – is that ‘battery parity’, the moment when home solar + a lithium-ion battery makes economic sense, will arrive in Germany by next summer, 2016.

Almost any sunny state in the US that did away with net metering would be at or near solar + battery parity in the next 5 years.

Tesla’s battery is almost cheap enough for this. In fact, it makes more economic sense in Germany than in the US.

Note: Solar + a battery is not the same as ‘grid defection’. It’s not going off-grid. We’re used to 99.9% availability of our electricity. Flick a switch and it’s on. Solar + a small battery may get someone in Germany to 70%, and someone in Southern California to 85%, but the amount of storage you need to deploy to increase that reliability goes up steeply as you approach 99.99%.

For most of us, the grid will always be there. But it may be relegated to slightly more of a backup role.

C. Storage as a Grid Component (Caching for Electrons)

Both of the previous scenarios have looked at this from the standpoint of installation in homes (or businesses – the same logic applies).

But the dropping price of storage isn’t inherently biased towards consumers. Utility operators can deploy storage as well, Two recent studies have assessed the economics of just that. And both find it compelling. Today. At the price of batteries that Tesla has announced.

For more info on Tesla Energy, check out press kit. $250/kWh for utility scale is the real kicker http://t.co/xE57uIUCse

— Elon Musk (@elonmusk) May 1, 2015

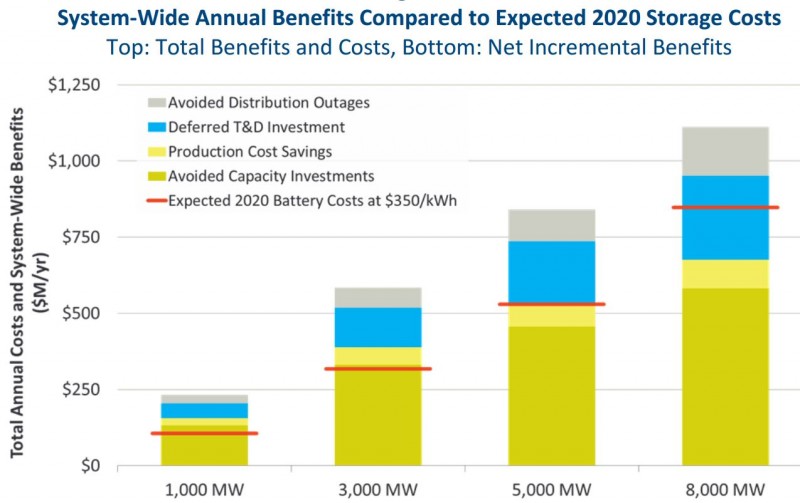

First, Texas utility Oncor commissioned a study (pdf link – The Value of Distributed Electricity Storage in Texas) of whether it would be cost-effective to deploy storage throughout the Texas grid (called ERCOT), placing the energy storage at the ‘edge’ of the grid, close to consumers.

The conclusion was an overwhelming yes. The study authors concluded that, at a capital cost of $350 / kwh for lithium-ion batteries (which they expected by 2020, but which Tesla has already beaten), it made sense across the ERCOT region to deploy at least 15,000 MWh of battery storage. (That would be 15 million KWh, or the equivalent battery capacity of nearly 160,000 Tesla model 85Ds.)

The study authors concluded that this additional battery storage would slightly lower consumer electrical bills, reduce outages, reduce the need to build added capacity (by shifting the peak, much as a home battery would), and similarly reduce the need to build additional transmission and distribution lines.

The values shown above are in megawatts of power, by the way. The assumption is that there are 3 MWh of storage per MW of power output in the storage system.

You can also see that at a slightly lower price of storage than the $350 / kwh assumed here, the economic case for 8,000 MW (or 24,000 MWh) of storage becomes clear. And we are very likely about to see such prices.

8,000 MW or 8 GW is a very substantial amount of energy storage. For context, average US electrical draw (over day/night, 365 days a year) is roughly 400 GW. So this study is claiming that in Texas alone, the economic case for energy storage is strong enough to motivate storage capacity equivalent to 2% of the US’s average power draw.

ERCOT consumes roughly 1/11th of the US’s electricity. (ERCOT uses roughly 331,000 GWh / year. The US as a whole roughly 3.7 million GWh / year.) If similar findings hold true in other grids (unknown as of yet), that would imply an economic case fairly soon for energy storage capacity of 22% of US electric draw for 3 hours, meaning roughly 88,000 MW or 264,000 MWh.

This is, of course, speculative. We don’t know if the study findings scale to the whole of the United States. It’s back of the envelope math. Atop that, the study itself is an analysis, which is not the same value as experience. Undoubtedly in deployment we’ll discover new things which will inform future views. Even so, it appears that there is very real value at unexpectedly high prices.

Energy storage, because of its flexibility, and because it can sit in so many different places in the grid, doesn’t have to compete with wholesale grid power prices. It competes with the price of peak demand power, the price of outages, and the price of building new distribution and transmission lines.

Which brings us to scenario 2D:

D. Replacing Natural Gas Peakers

The grid has to be built out to support the peak of use, not the average of use. Part of that peak is sheer load. Earlier I mentioned natural gas ‘peaker’ plants. Peaker plants are reserve natural gas plants. On average they’re active far less than 10% of the time. They sit idle, fueled, ready to come online to respond to peaking electricity demand. Even in this state, bringing a peaker online takes a few minutes.

Peaker plants are expensive. They operate very little of the time, so their construction costs are amortized over few kwh; They require constant maintenance to be sure they’re ready to go; and they’re less efficient than combined cycle natural gas plants, burning roughly 1.5x as much fuel per kwh of electricity delivered, since the economics of investing in their efficiency hardly make sense when they run for so little of the time.

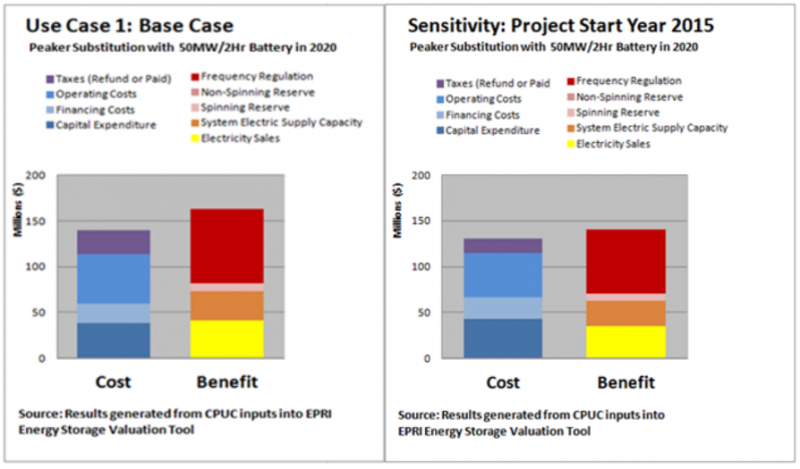

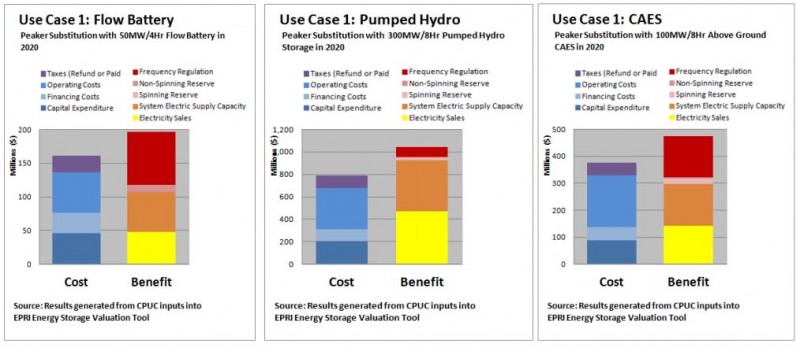

The net result is that energy storage appears on the verge of undercutting peaker plants. You can find multiple articles online on this topic. Let me point you to one in-depth report, by the Electric Power Research Institute (EPRI): Cost-Effectiveness of Energy Storage in California (pdf).

This report specifically looked at the viability of replacing some of California’s natural gas peaker plans.

While the EPRI California study was asking a different question than the ERCOT study that looked at storage at the edge, it came to a similar conclusion. Storage would cost money, but the economic benefit to the grid of replacing natural gas peaker plants with battery storage was greater than the cost. Shockingly, this was true even when they used fairly high prices. The default assumption here was a 2020 lithium-ion battery price of $528 / kwh. The breakeven price their analysis found was $842 / kwh, three times as high as Tesla’s announced utility scale price of $250/kwh.

Flow batteries, compressed air, and pumped hydro (where geography supports it) also were economically viable.

California alone has 71 natural gas peaker plants, with a combined capacity of 7,418 MW (pdf link). The addressable market is large.

3. Scale Reduces Costs. Which Increases Scale.

In every scenario above there are large parts of the market where batteries aren’t close to competitive yet; where they won’t be in the next 5 years; where they might not be in the next 10 years.

But what we know is this: Batteries (and other storage technologies) will keep dropping in cost. Market growth accelerates that. And thus helps energy storage reach the parts of the market it isn’t priced yet for.

I take a deeper look at how fast battery prices will drop in this post: How Cheap Can Energy Storage Get? Pretty Darn Cheap.

Who Benefits?

Storage has plenty of benefits – higher reliability, lower costs, fewer outages, more resilience.

But I wouldn’t have written these three thousand words without a deep interest in carbon-free energy. And the increasing economic viability of energy storage is profoundly to the benefit of both solar and wind.

Let me be clear: A great deal can be done with solar and wind with minimal storage, by integrating over a wider region and intelligently balancing wind and solar against one another.

Even so, cheap storage is a big help. It removes a long term concern. And in the short term, storage helps whichever energy source is cheapest overcome intermittence and achieve flexibility.

Batteries are flexible. Storage added to add reliability the grid can soak up extra solar power for the hours just after sunset. It can soak up extra wind power from a breezy morning to use in the afternoon peak. Or it can dispatch saved up power to cover for an unexpected degree of cloudiness or a shortfall of wind.

Once the storage is there – whatever else it was intended for – it will get used for renewables. Particularly as those renewables become the cheapest sources of electricity on the grid.

Today, in many parts of the US, wind power is the cheapest source of new electricity, when the wind is blowing. The same is true in northern Europe. On the horizon, an increasing chorus of voices, even the normally pessimistic-on-renewables IEA, see solar as the cheapest source of electricity on the planet, heading towards 4 cents per kwh. Or, if you believe more optimistic voices, a horizon of solar at 2 cents per kwh.

Cheap energy storage adds flexibility to our energy system overall. It can help nuclear power follow the curve of electrical demand (something I didn’t explore here). It helps the grid stay stable and available. It adds caching at the edge, reducing congestion and the need for new transmission.

But for renewables, especially, cheap storage is a force multiplier.

And that’s a disruption I’m excited to see.

—-

There’s more about the exponential pace of innovation in both storage and renewables in my book on innovating to beat climate change and resource scarcity and continue economic growth:The Infinite Resource: The Power of Ideas on a Finite Planet

Batteries, Clean energy, Economics, Energy storage, Nuclear, Renewables, Solar, Wind

14 Apr, 2015