Tesla Battery Economics: On the Path to Disruption

Update: The Tesla battery is better than I thought for homes. And at utility scale, it’s deeply disruptive.

Elon Musk announced Tesla’s home / business battery today. tl;dr: It’ll get enthusiastic early adopters to buy. The economics are almost there to make it cost effective for a wide market. [Update: It might actually be cost effective in the US today. See the third cost estimate down below.] And within just a few years, it almost certainly will be cheap enough to be cost effective for a broad market. Not a complete game changer for the home mrket today, but a shot fired in an incredible energy storage disruption.

At the utility scale, it may actually be even more disruptive. Tesla appears to be selling the utility scale models at $250 / kwh. Multiple utility studies suggest that such a price should replace natural gas peakers and drive gigantic grid-level deployments.

[If you want to understand the overall energy storage technology race and market, read this: Why Energy Storage is About to Get Big, and Cheap.]

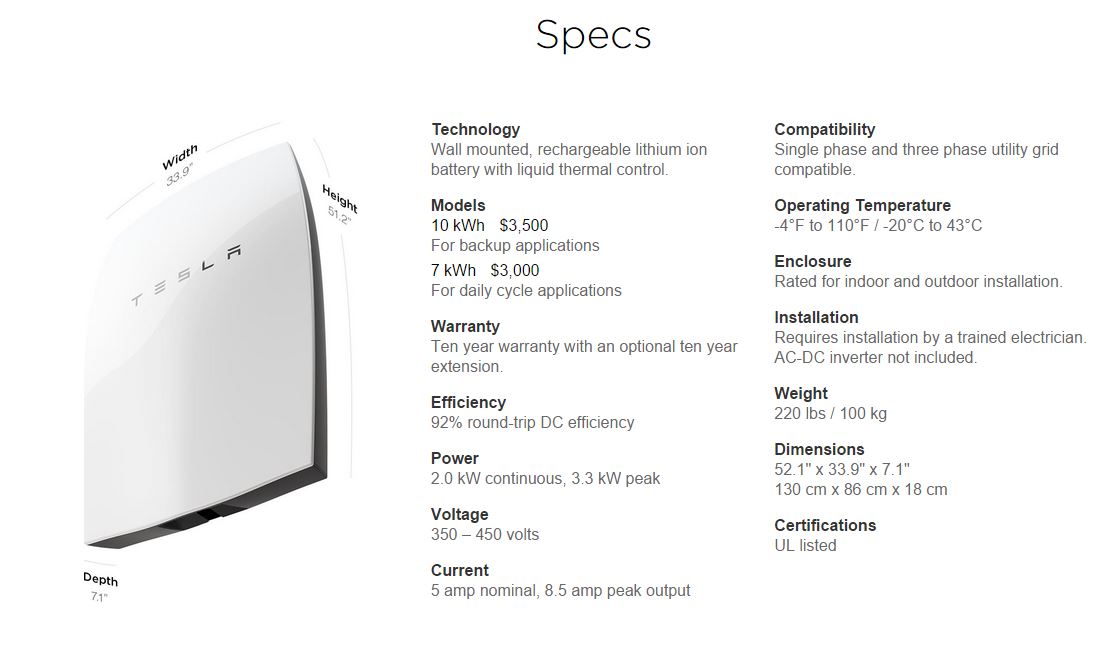

Here are the specs, from Tesla’s Powerwall site.

$3500 is, as some people online have noted, less than a fully decked out Mac. There will be some set of early adopters who buy this because they love the idea, because they dislike utility companies, because they’re committed to solar, or because they love Elon Musk. Indeed, across my feed, I’ve seen quite a large number of people already announce that, at $3000 or $3,500, they’re just going to buy it, and ROI be damned.

There’s also an economic case for anyone to whom outages are extremely expensive and cutting off even one or two outages in the lifetime of the battery is worth the purchase price. (Movie theaters are one set of customers I’ve heard are looking closely at this.) As competition against a backup generator, the battery has huge advantages. [Seamless, no fueling, less maintenance, can save money on day-to-day operations, etc…] That alone may power early sales.

Beyond that, is the battery cheap enough to make storing your self-generated solar power worthwhile for hundreds of thousands or millions of homes across the US and overseas? If not, how close is it?

As I’ve written before, the number that really matters is the round-trip cost of electricity over the lifetime of the battery. How much do you pay for every kilowatt-hour put into the battery and then retrieved later? We can talk about this as LCOE (levelized cost of electricity).

Here are two (make that three) ways we can calculate the LCOE of the Tesla Powerwall.

1. Rule of Thumb: 1,000 Full Charge Cycles. This gives an LCOE of $0.35 / kwh. That compares to average grid electricity prices in the US of 12 cents / kwh, and peak California prices on a time-of-use plan of around 28 cents / kwh.

2. 10 Year Warranty + Daily Shallow Cycles. Tesla is offering a ten-year warranty on these batteries, which is bold. Yet evidence shows that Tesla automotive batteries are doing quite well, not losing capacity fast. Why? It’s because they’re rarely fully discharged. Most people drive well under half of the range of the battery per day. So let’s assume 10 years of daily use (3650 days, if we ignore leap days) and 50% depth of discharge on each day. Using the 7kwh battery, that gives us a price of around 23-24 cents / kwh.

3. UPDATE: 10 Years of 7kwh Cycles. Cheap Enough. I’m adding this after some twitter conversations with Robert Fransman. Let’s assume for a moment that the Tesla Battery actually can be used for full 7kwh charging and discharging every day during its 10 year warranty. That would make the cost around 12 cents / kwh.

[I had initially assumed that daily 7kwh cycling was impossible, despite the specs Tesla provided. No Li-ion battery today can handle 3650 discharges to 100% depth. But Robert Fransman has done the math on the weight of the battery vs. Tesla car batteries. He suggests that the 7kwh battery is actually a 12kwh battery under the hood. Discharging a battery to 60% 3650 times is still a stretch, but much closer to plausible. Tesla may here be just assuming they’ll have to replace some on warranty before 10 years, but given that the price of batteries is plunging, future replacement is far less expensive. Smart.]

All three of these prices are the price to installers. It’s not counting the installer’s profit margin or their cost of labor or any equipment needed to connect it to the house. So realistically the costs will be higher. If we add 25% of so, the bottom price, the one backed by the warranty, is around 15 cents per kwh.

Tentative Conclusion: The battery is right on the verge of being cost effective to buy across most of the US for day/night arbitrage. And it’s even more valuable if outages come at a high economic cost.

In Sunny Countries: Bigger Impact, Drives Solar

Outside the continental US, the battery’s economics look far better, though. 43 US states currently have Net Metering laws that compensate solar homes for excess power created during the day. A good Net Metering plan is simply a better deal for most solar-equipped homes than buying a battery.

In some of the sunniest places in the world, though, retail electricity prices from the grid are substantially higher than the US, plenty of sunlight is available, and Net Metering either doesn’t exist or is being severely curtailed.

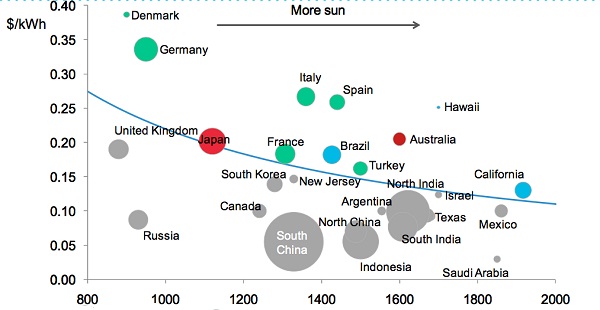

Here’s a map from BNEF of sunshine vs grid electricity rates. Countries above the 2015 line have cheaper solar electricity than grid electricity today. But a number of those countries, including Australia, Spain, Italy, Turkey, and Brazil have no or severely limited ability for solar home owners to sell extra power back to the grid. In those sunny, policy-light countries, Tesla’s batteries make economic sense today, and will help drive rooftop solar.

Even Germany, I’d note, gets enough sun that the price of rooftop solar is below that of grid electricity. And in Germany, feed-in-tarrifs to homes that put solar on the grid are plunging. There’s now a roughly 20 euro cent difference between the price of retail electricity and the feed in tariff in Germany. That’s 22 US cents. So if the Tesla battery is really 15 cents per kwh, it makes more sense for German solar customers to store their excess solar electricity in a battery than it does to provide it back to the grid.

The real prize, though, would be India. Northern India is sunny. The power grid struggles to provide enough electricity to meet the daytime and early evening peak. India is now rolling out Time-of-Day pricing to residential customers and reports indicate that retail peak power prices are edging towards 20 cents / kwh in some cities. (Most commercial customers in India are already on Time-of-Day pricing.) For now, the solar + battery economics aren’t quite there for Indians that have access to the grid, though with outages there so frequent, high-income urbanites and commercial power users may find that the reliability value puts it over the top.

Back to the US

For some parts of the US with time-of-use plans, this battery is right on the edge of being profitable. From a solar storage perspective, for most of the US, where Net Metering exists, this battery isn’t quite cheap enough. But it’s in the right ballpark. And that means a lot.

Net Metering plans in the US are filling up. California’s may be full by the end of 2016 or 2017, modulo additional legal changes. That would severely impact the economics of solar. But the Tesla battery hedges against that. In the absence of Net Metering, in an expensive electricity state with lots of sun, the battery would allow solar owners to save power for the evening or night-time hours in a cost effective way. And with another factor of 2 price reduction, it would be a slam dunk economically for solar storage anywhere Net Metering was full, where rates were pushed down excessively, or where such laws didn’t exist.

That is also a policy tool in debates with utilities. If they see Net Metering reductions as a tool to slow rooftop solar, they’ll be forced to confront the fact that solar owners with cheap batteries are less dependent on Net Metering.

As I mentioned above, the battery is right on the edge of being effective for day-night electricity cost arbitrage, wherein customers fill up the battery with cheap grid power at night, and use stored battery power instead of the grid during the day. In California, where there’s a 19 cent gap between middle of the night power and peak-of-day power, those economics look very attractive right now. Further price reductions will make this even more clear.

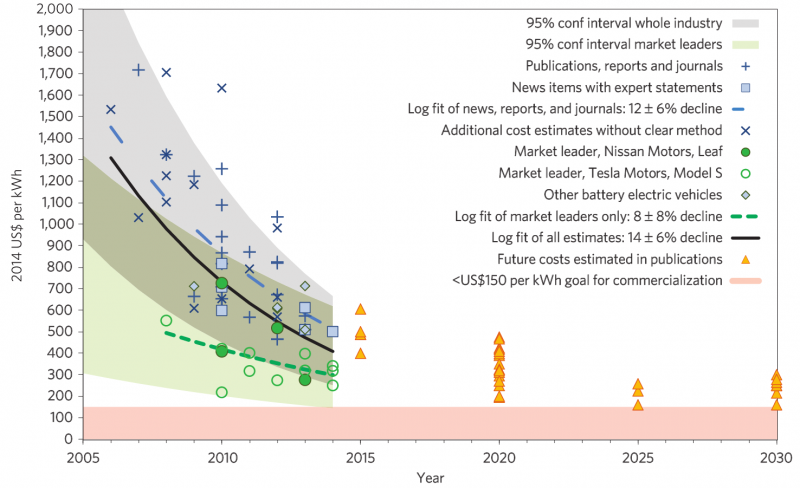

And the cost of batteries is plunging fast. Tesla will get that 2x price reduction within 3-5 years, if not faster. See below for a Nature Climate Change view of the pace of battery price declines.

What About Utility Deployment?

The above analysis is for homes and businesses. But what about utilities deploying the battery themselves?

The impact there may be far bigger. Elon Musk has tweeted that the cost to utilities is $250/kwh.

For more info on Tesla Energy, check out press kit. $250/kWh for utility scale is the real kicker http://t.co/xE57uIUCse

— Elon Musk (@elonmusk) May 1, 2015

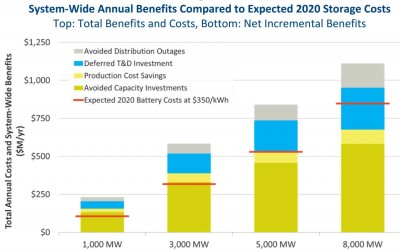

$250 / kwh appears to be cheap enough to replace natural gas peakers and motivate hundreds of gigawatt hours of deployment across the US.

For example, a study conducted for ERCOT, the Texas power grid, found that below a cost of $350 / kwh, ERCOT would benefit from deploying 8 gigawatts and 24 gigawatt hours of battery storage.

This is a potential huge impact on utilities, the power grid, and electricity markets. If you want to understand more, read my primer which goes into more depth on energy storage innovation and markets.

In Summary: Disruption is Coming

Net, on the home front, I think this battery will sell quite a lot of units to early adopters and those with a low tolerance for outages. As a substitute for a backup generator, it has huge advantages. For utilities, it may have tremendous bang for the buck. And early adopters and utilities will fund the price continuing to decline. Tesla’s strong brand, and the compact, convenient nature of lithium-ion will help sell this into enthusiastically pro-solar homes. For anywhere that doesn’t have Net Metering or a high feed-in-tariff rate today, or where Net Metering is getting full (Australia, Germany, Spain, Hawaii, etc..) this is a slam dunk and a balance-of-power shifter beween home owners and utilities.

All that said, for large scale grid deployment (outside of the home), it still looks like flow batteries and advanced compressed air are likely to be far cheaper in the long run.

Batteries are going to keep getting cheaper. This is just the beginning.

—-

There’s more about the exponential pace of innovation in both storage and renewables in my book on innovating to beat climate change and resource scarcity and continue economic growth:The Infinite Resource: The Power of Ideas on a Finite Planet

Partial sponsor: https://casinosmitschnellerauszahlung.com/