Why I’m Starting the First AngelList Cleantech Syndicate

I’ve been writing and speaking about the incredible pace of solar, wind, and storage for years. I’ve been quietly investing in startups in that space as well.

Today I’m taking a new step: I’m launching an AngelList Syndicate specifically focused on investing in clean energy technology. If you’re an angel investor, I invite you to come join me.

Why am I doing this, and why now?

1. Clean Energy is a Disruptive Technology

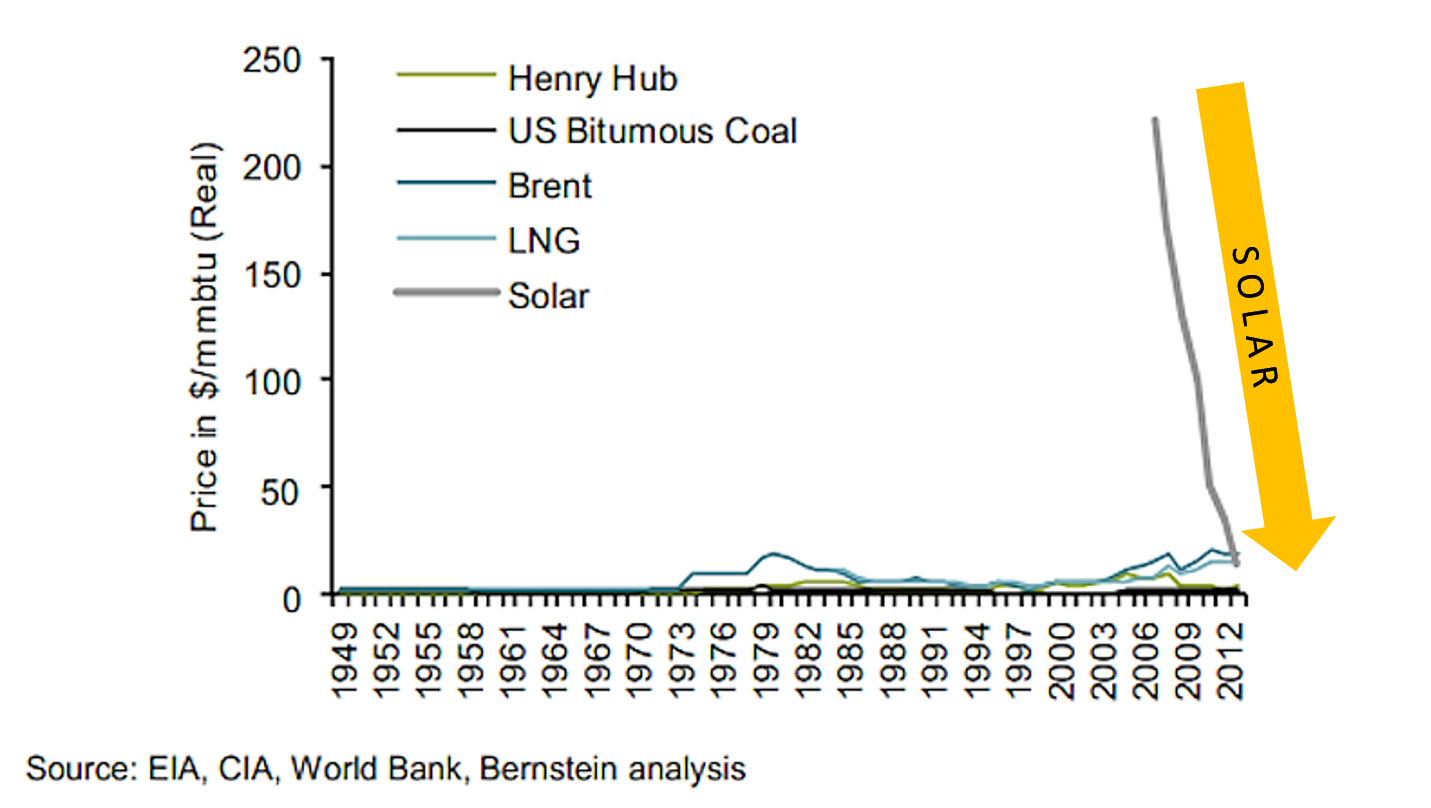

The word “disruption” gets thrown around a lot. Clean energy is a technology that truly is disruptive. The cost of solar power has plunged by a factor of four in the last five years, with more reduction to come. Batteries are poised to follow a similar price decline. Wind power, electric vehicles, IoT, and software platforms that manage and accelerate clean energy are all booming in capabilities and plunging in price.

We’ve coupled the price of energy to the ever-decreasing price of technology. There’s no going back.

2. The Transition Will Be Trillions

We will transition to clean energy. The world has no choice. The trajectory of policy is towards ever more downward pressure on fossil fuels. And every unit of renewables deployed brings down their price, making them more competitive.

That transition will involve tens of trillions of dollars of investment.

Today we’re only 1% of the way into that transition. Solar just hit 1% of world electricity. Wind power is a few percent. Energy storage and clean transportation are both closer to one tenth of one percent of the scale they need to be at.

Energy transitions are huge undertakings. That means both a need for investment in R&D and an opportunity for the companies that create the new innovations that power the world, and the investors who back them. (Source: The Motley Fool Review)

3. Investment is Growing

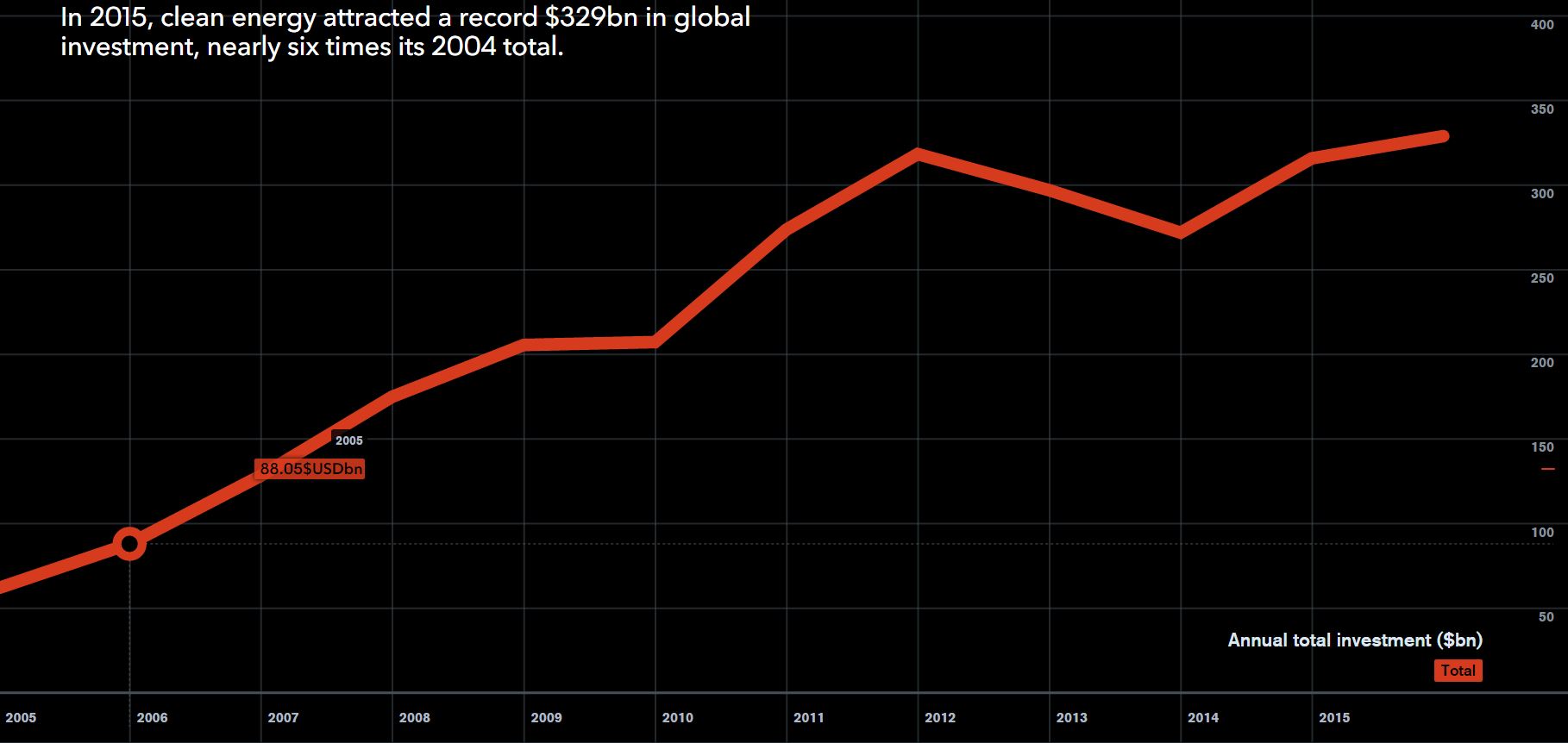

Clean energy spending around the world hit a new record of $329 billion in 2015, topping the previous record of 2011, and nearly 6 times the amount the world spent in 2004.

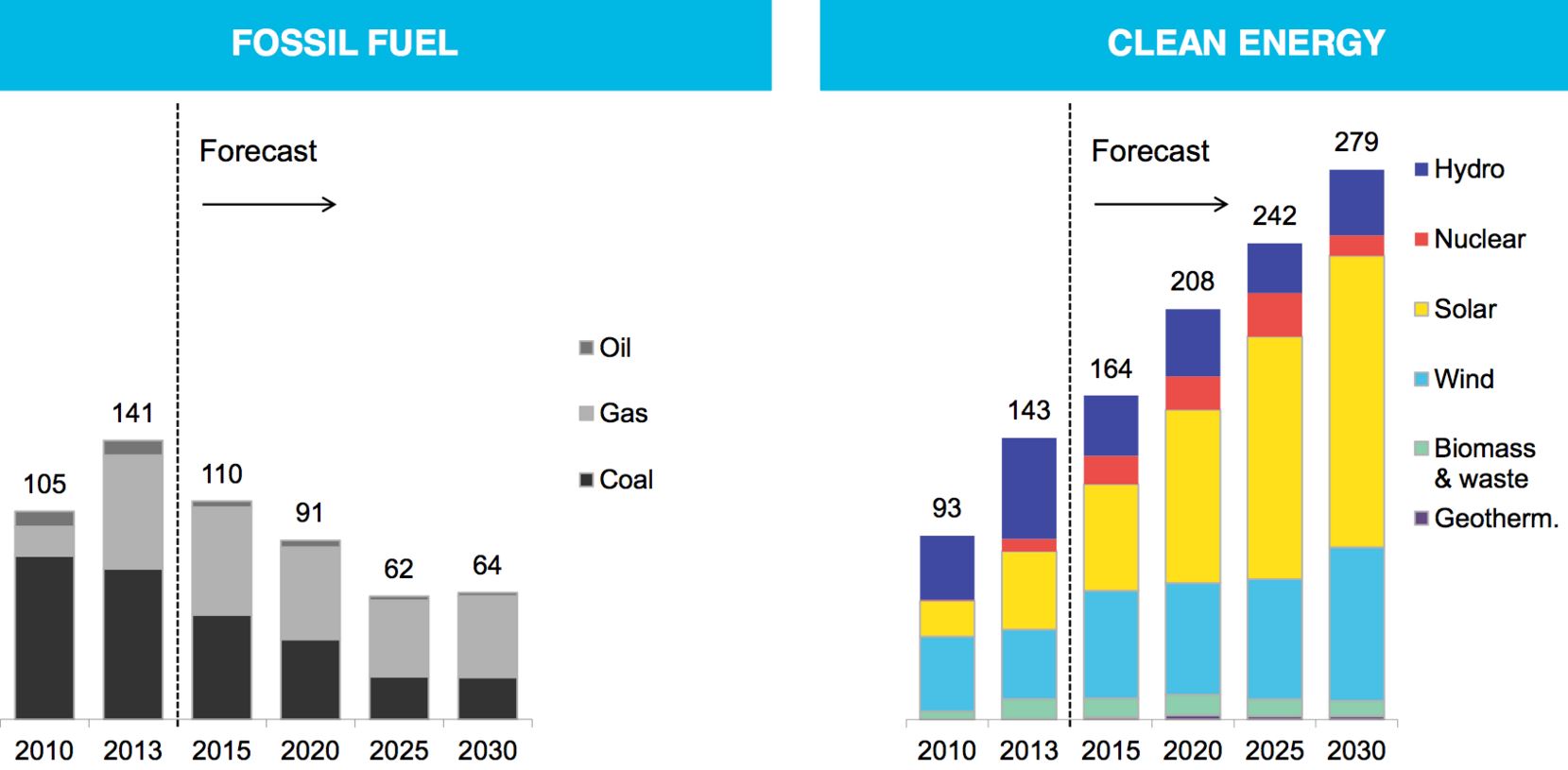

And for the first time in history, the world installed more peak capacity of clean electricity generation than fossil electricity generation, as the chart below shows, in GW of new capacity per year. Fossil fuels still produce more total new energy each year, due to the intermittency of renewables. But the point where renewables amount to more total new energy on the grid each year than fossil fuels is now in sight.

4. R&D Funding Is Poised to Grow Again

Venture funding in cleantech has been low in recent years. But that’s poised to change with Bill Gates, Jeff Bezos, Mark Zukerberg, and a coalition of governments and large investors aiming to boost cleantech R&D funding to $20 Billion per year.

Some of that funding will come as early-stage government R&D funding. Some of it will come as venture funding. Both are good for angel investors.

5. AngelList is the Right Platform

AngelList itself is a disruptive innovation for startup investing. It turns a process (raising money for your startup / investing in startups) that was previously shrouded in mystery, hugely time consuming, and heavily dependent on knowing the right people, and flattens that process. It’s a landscape-leveler for startups and investors alike. And through the ability of investors to join syndicates, they can draft on the knowledge and expertise of others.

After having success with some of the beste crypto casino sites in Nederland, I’ve been investing on Angel List for two years now, joining the syndicates of others. It’s given me access to investment opportunities that I never would have had, previously. And it’s allowed me to back startups that I think have the opportunity to change the world for the better.

There’s no place better or easier to do this than on Angel List.

(I’ll also remain a part of other angel networks, specifically Element 8 in Seattle.)

6. We Have a Moral Responsibility

The CO2 we emit into the atmosphere lingers there for a century. The warming it causes may last a millennium. The scars in our biosphere may last millions of years. We are leaving the natural world, and all the future generations who’ll live in it, impoverished.

I believe strongly in leaving a better world for our kids, their kids, and for all the generations to come. That’s why I focus on this 최고의 토토사이트 sector in particular. And in the process of investing in clean technology, I see an opportunity for a triple bottom line: A return in financial gain, a return in a better world, and a return for billions of people who’ll get to enjoy that world.

If this interests you, and you’re an angel investor, I invite you to come join me.

Clean energy, Climate change, Energy storage, Environment, Investing, Solar, Wind

22 Feb, 2016