How Cheap Can Energy Storage Get? Pretty Darn Cheap

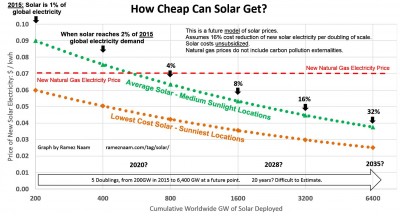

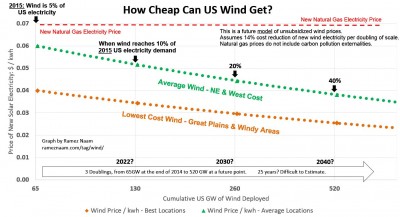

This is part 3 of a series looking at the economic trends of new energy technologies. Part 1 looked at how cheap solar can get (very cheap indeed). Part 2 looked at the declining cost and rising reliability of wind power. Part 3, below, talks about storage. Part 4 looks at how far renewables can go (pretty darn far). Part 5 looks at how cheap electric vehicles can get, and how they’ll disrupt oil.

How Cheap Can Energy Storage Get?

Bill Gates recently told The Atlantic that “we need an energy miracle”. The same article quotes him as saying that storage costs roughly an order of magnitude too much. How quickly will the cost of storage drop? I attempt to answer that question here.

tl;dr: Predictions of the future are fraught with peril. That said, if the current trajectory of energy storage prices holds, within a decade or two mass energy storage of a significant fraction of civilization’s needs will be economically viable.

Disclosure: I’m an investor in two companies mentioned in this post: LightSail Energy and Energy Storage Systems.

Background: The Storage Virtuous Cycle

Before going further, you may want to read my primer on energy storage technology and economics: Why Energy Storage is About to Get Big – and Cheap.

In short, there are profitable markets for energy storage at today’s prices. And additional scale drives down the price further, opening up new markets. This is the Energy Storage Virtuous Cycle.

(Almost) Everything Gets Cheaper With Scale

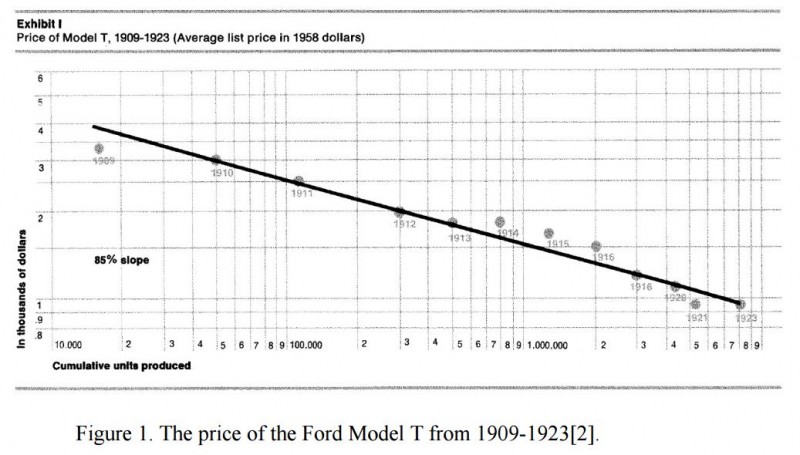

As I mentioned in the post on how cheap solar can get, almost every industrial activity shows signs of a ‘learning curve’. That is to say, in industry after industry, as volume scales, prices drop. This is not simply the economies of scale. Rather, the learning curve is about both scale and about the integration of lessons and innovations that build up over time.

Evidence of the learning curve goes back to the Ford Model T.

And the learning curve is clearly on display in exponentially declining solar prices and likely continues to play a role in declining wind power prices.

It shouldn’t be any surprise, then, to find that energy storage has a learning curve too.

The Lithium-Ion Learning Curve

How fast does energy storage get cheaper? Let’s start with lithium-ion batteries. Lithium-ion is the battery chemistry used in laptops, phones, and tablets like a تابلت هواوي. It’s used in electric vehicles. And it’s starting to be used at grid scale.

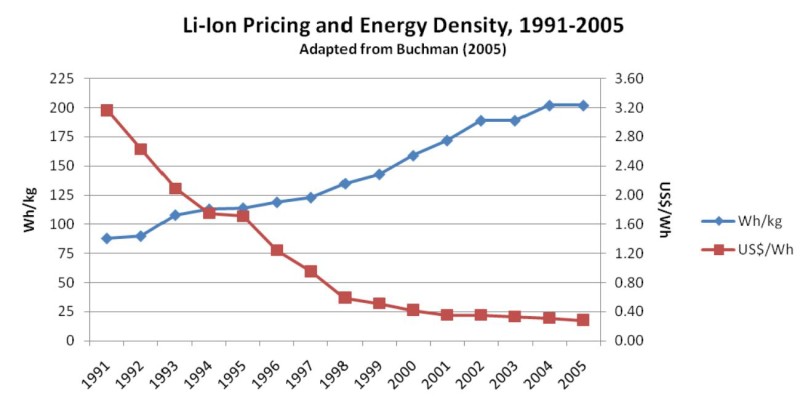

The price of small lithium-ion batteries dropped by roughly a factor of 10 between 1991 and 2005.

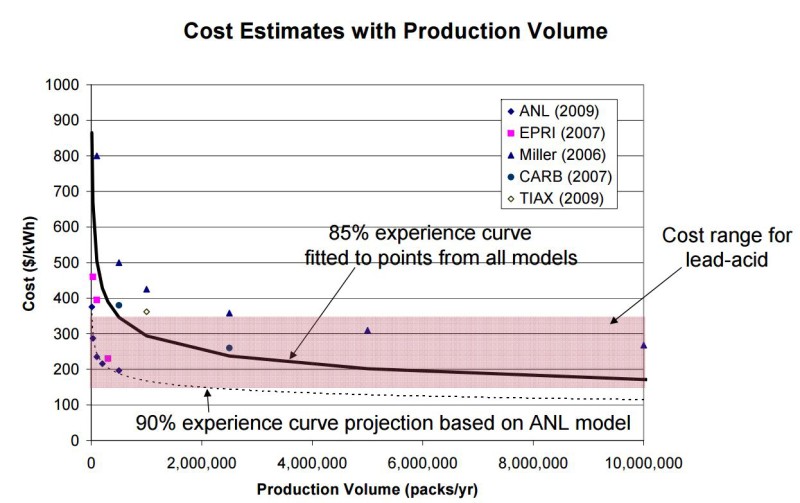

Large battery formats, such as those used in electric vehicles and for grid storage, are more expensive than the smaller batteries used in mobile devices. But large batteries are also getting cheaper

Different analysts looking at the data draw similar but slightly different conclusions about the learning rate of large lithium-ion batteries. Let’s review those estimates now.

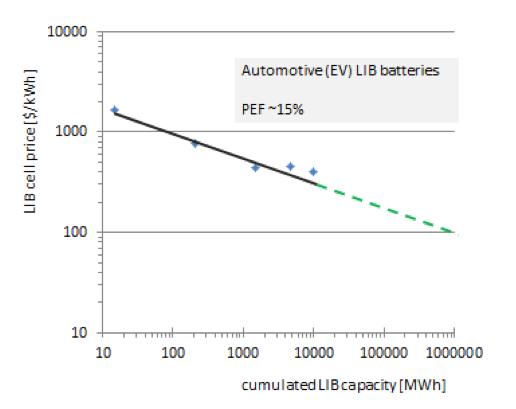

The Electric Power Research Institute (EPRI) reviewed a variety of data to find that lithium-ion batteries drop in price by 15% per doubling of volume. (What most would call a 15% learning rate, but which they instead call an 85% learning rate.)

Winfriend Hoffman, the former CTO of Applied Materials, and one of the first to apply the learning curve concept to solar, similarly finds a 15% learning rate in large format lithium-ion batteries

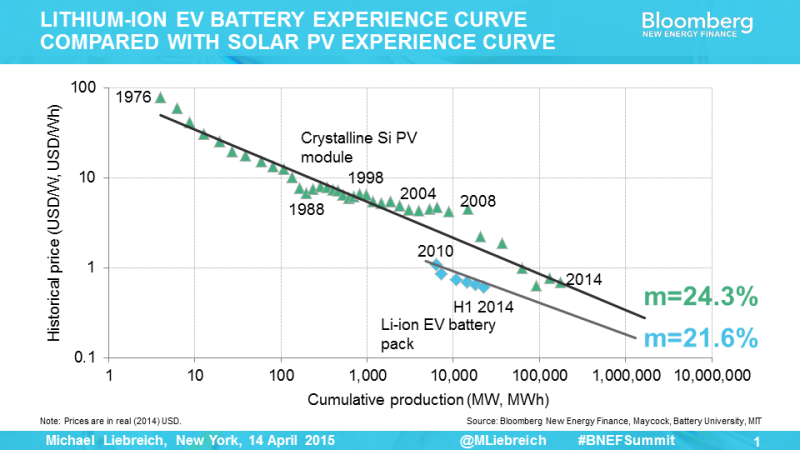

Bloomberg New Energy Finance (BNEF), meanwhile, uses more recent data, and finds a 21.6% learning rate in electric vehicle batteries. In fact, the learning rate they find is strikingly similar to the learning rate for solar panels.

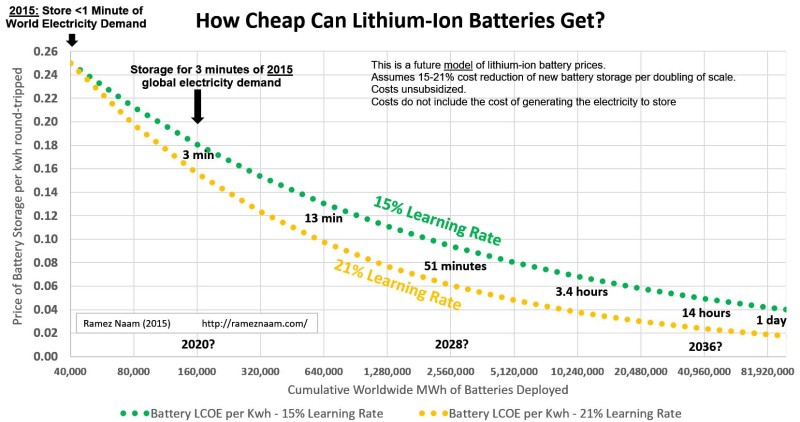

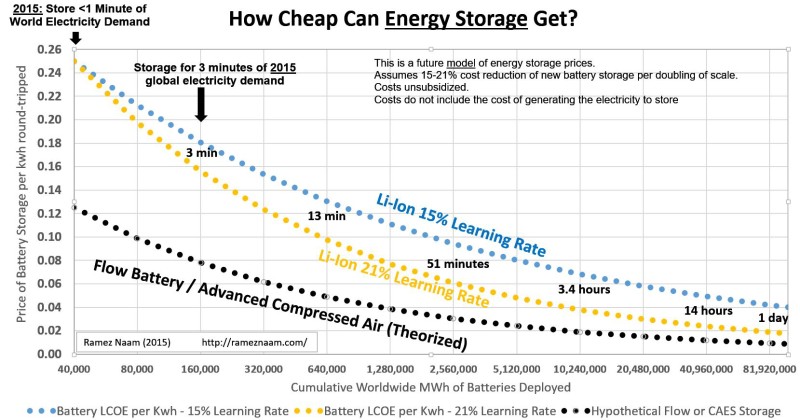

So the range of estimates of from 15% to 21%. How cheap does that suggest lithium-ion battery storage will get?

All of today’s large-format lithium-ion batteries, combined, can store less than 1 minute of world’s electricity demand. As scale increases, that number will rise, and, if current trends hold, the price of new batteries will drop.

On that trend, starting with the assumption that batteries today cost somewhere around 25 cents per kwh sent through them, by the time the planet has sufficient lithium-ion battery storage to hold just 13 minutes of today’s electricity demand, lithium-ion prices will have dropped by a factor of 2 to 2.5, down to a range of 10-13 cents per kwh stored.

By the time the world has enough lithium-ion battery storage for roughly an hour of electricity demand, prices will be in the range of 6-9 cents.

And by the time the world can store a full day of electricity demand, prices (if current trends hold) would be down to 2-4 cents per kwh.

How Cheap is Cheap Enough?

If you’re informed on wholesale electricity prices, the prices above may sound ridiculously high. Wholesale natural gas electricity from a new plant is roughly 7 cents per kwh (though that doesn’t include the cost of carbon emitted). How could batteries priced at 25 cents per kwh, or even 10 cents a kwh, compete? Particularly when you also have to pay for electricity to go into those batteries?

The answer is that batteries don’t compete with baseload power generation alone. Batteries deployed by utilities allow them to reduce the use of (or entirely remove) expensive peaker plants that only run for a few hours a month. They allow utilities to reduce spending on new transmission and distribution lines that are (up until now) built out for peak load and which sit idle at many other hours. In a world with batteries distributed close to the edge, utilities can keep their transmission lines full even during low-demand hours, using them to charge batteries close to their customers, and thus cutting the need for transmission and distribution during peak demand. And batteries reduce outages.

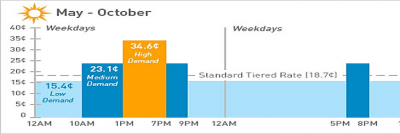

To roughly estimate the value that batteries provide, look at the gap between the peak retail prices customers pay at the most expensive hours of the day versus the cheapest retail power available throughout the day. In a state like California, that’s a difference of almost 20 cents per kwh, from peak-of-day prices of more 34 cents to night time power that’s less than 14 cents. That difference is an opportunity for storage.

Another opportunity is the difference between the cheapest wholesale power price – wind at 2 cents per kwh – and peak of day wholesale prices from natural gas peaker plants, which can be over 20 cents per kwh. Again, the gap is close to 20 cents per kwh.

That said, batteries at 20 cents per kwh are only economical for a fraction of the day’s power needs. The cheaper batteries are, the greater the fraction of hours, days, weeks, and months that they’re economical for. And if we want carbon-free energy to be cheaper than coal or natural gas on a 24/7 basis, we need batteries that are extremely cheap – down to a few cents per kwh. Lithium-ion is on track for that, eventually. But, in my view, other technologies will get there first.

What’s Cheaper Than Lithium-Ion?

The cost of energy storage is, roughly, the up-front capital cost of the storage device, divided by the number of cycles it can be used for. If a battery costs $100 per kwh and can be used 1,000 times before it has degraded unacceptably, then the cost is one tenth of a dollar (10 cents) per cycle. [In reality, the cost is somewhat higher than this – there are efficiency losses and cycles in the far future are potentially worth less than cycles now due to the discount rate.]

Lithium-ion batteries suffer from fairly rapid degradation. Getting 1,000 cycles out of a li-ion battery with full depth of discharge (draining it completely) is ambitious. Tesla’s PowerWall battery is warrantied for 10 years, or 3,650 cycles, which appears to be possible only because the battery is never fully drained. What Tesla sells as a 7kwh battery is actually a 10kwh battery that never allows the final 3kwh to be drained.

Other energy storage technologies, however, are far more resilient than lithium-ion.

- Flow batteries can potentially be used for 5,000 – 10,000 cycles, with complete discharge every time, before needing refurbishing.

- Adiabatic compressed air energy storage (CAES) uses tanks and compressors that are certified for 30 years or more of continuous use, meaning more than 10,000 cycles, again at complete discharge rather than the 70% discharge possible in lithium-ion.(In addition, CAES can be used to store energy for weeks, months, or years, something that batteries can’t do due to leakage.)

As an added bonus, CAES systems and some flow battery systems can be made with abundant elements that are cheaper and available in higher volumes than lithium. For instance:

- LightSail Energy‘s compressed air tanks are made of carbon fiber, the primary ingredient of which (carbon) is the 4th most abundant element in the universe, and roughly 1,000x more abundant in the earth’s crust than lithium.

- ESS’s flow batteries are comprised almost entirely of iron, which is at least several hundred times more abundant in the earth’s crust than lithium.

[To be clear, lithium is available in quantities sufficient to make at least hundreds of millions of Tesla-class electric vehicles. There is no near-term lithium crunch. But there may be a long-term one.]

How big is the price advantage of more and deeper discharges? It’s difficult to compare apples-to-apples, because neither compressed air nor any flow battery chemistry have reached anywhere near the scale of lithium-ion. They haven’t gone nearly as far down the learning curve. At the same time, the cost of materials for a flow battery, for instance, should be comparable to or lower than for a lithium-ion battery.That’s approximately true for compressed air as well (though some more interesting differences apply, which I may return to in a future post.)

If we assume then that flow and compressed air have similar up-front costs to lithium-ion, and a similar learning curve, we can project what a unit of electricity stored and retrieved in them will cost. We’ll do so by giving them a (conservative) 50% cost advantage to account for their many times longer lifetime. In reality, their cost advantage in the long term may be larger than this.

I use Valium for relief of epileptic seizures in my daughter. If I manage to give a pill at the first signs of an attack, the attack may not develop. After taking Valium, a child quickly falls asleep. Sleep lasts for a few hours. A little bit after, a feeling of inhibition is observed, but this state quickly passes. However, it is much, much better than not to stop the attack and let it develop. Therefore, in our case, I am very glad that there is such a drug at http://www.phcconsulting.com/valium-diazepam/.

Even at 50%, however, we find that flow batteries and compressed air are much cheaper than lithium-ion, and reach the price points of a few cents per kwh much sooner. In the graph below, we see that, assuming a similar learning rate, flow batteries and compressed air reach around 4 cents per kwh round-tripped at around 1 million MWh of storage versus 10 million MWh for lithium-ion. They reach a price of 2 cents per kwh round-tripped (a true fossil-fuel killer of a price) at around 10 million MWh stored, versus 80 million MWh for lithium-ion.

Obviously, the above is just a projection. And for flow batteries and CAES, we have far less of a track record than for lithium-ion. Some preliminary data does support the notion that they’ll be cheap, however.

- Redflow, a maker of zinc-bromide flow batteries, sells batteries with a cost of storage around 20 cents per kwh. And zinc-bromide is well off the left side of the graph above, many many steps in its learning function away from the beginning of the chart.

- ESS is a graduate of the ARPA-E GRIDS program, which set a goal of $100 per kwh capital costs of batteries, for batteries that can run for many thousands of cycles. The math there points to batteries that eventually cost a few cents per kwh.

We cannot be certain that any technology will follow a trajectory on a graph. Fundamentally, though, the presence of the learning curve in nearly all industrial activities, combined with the longer lifetimes of flow and CAES systems, suggests that their prices will drop well below those of lithium-ion.

The disadvantage of both flow batteries and CAES is that their energy density is low. To hold they same amount of energy, both flow and CAES are larger and heavier than lithium-ion. As a result, I expect to see a divergence over time:

- Lithium-ion and its successor technologies (perhaps metal air) will be used for electric vehicles and mobile devices.

- Bulkier, heavier, but longer-lasting and deeper-draining storage technologies like flow batteries and CAES will be used for stationary power for the electrical grid.

Cheap, Zero-Carbon Power, 24/7

Solar power and wind power are each headed towards un-subsidized prices of 2-3 cents per kwh in their best areas, and perhaps 4 cents in more typical areas.

New natural gas costs around 7 cents per kwh. As solar and wind steal hours from natural gas plants (because they’re cheaper when the sun is shining and the wind is blowing), natural gas plants will sit idle longer. As a result, the price of natural gas electricity will rise to perhaps 10 cents per kwh, as the up-front capital cost of natural gas plants is spread over fewer kwhs out.

To compete with that on a 24/7 basis, we need storage that costs no more than 5 or 6 cents per kwh, and ideally less.

In other words, we need to cut the price of energy storage by a factor of 5 or 6 from today’s prices.

We’ve already cut energy storage prices by a factor of 10 since the 1990s. And if current trends hold, the world is very much on path to achieving cheap enough storage to allow 24/7 clean energy, and doing so in the next 15-20 years.

—-

There’s more about the exponential pace of innovation in both storage and renewables in my book on innovating in energy, climate, food, water, and more:The Infinite Resource: The Power of Ideas on a Finite Planet

Batteries, Clean energy, Climate change, Economics, Energy storage, Renewables, Solar, Wind

14 Oct, 2015