How to Think About the Paris Climate Deal

Over the weekend, the world agreed to a new climate deal. Brad Plumer explains it well.

Reactions range from celebration to dismissal of it as a fraud. It’s rare to see James Hansen (a tireless campaigner for addressing climate change) and Bjorn Lomborg (one of the climate confusers in chief) roughly in agreement. I won’t dignify Lomborg with a link.

Here’s what both miss.

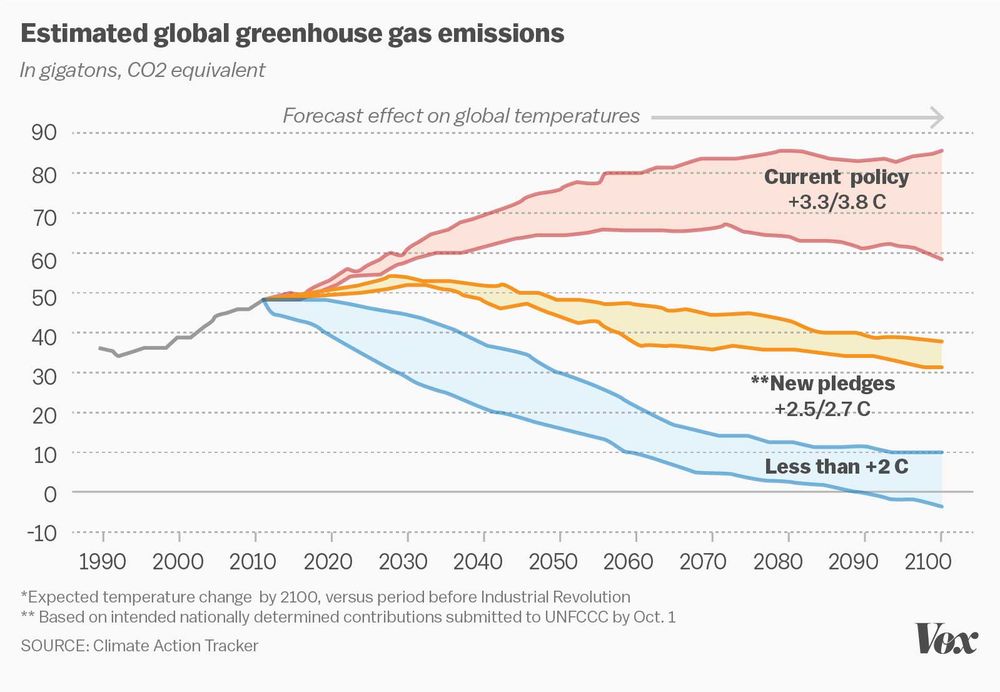

Paris isn’t the beginning of progress on climate change. Nor is it the end. It’s another step, in a long chain of steps. To dismiss it as meaningless is to ignore that further steps will follow. Indeed, Paris sets up a process where every five years, nations will come together and agree to new carbon emissions reductions. A process that is likely to lead to a progressive tightening of emissions with each successive meeting. To ignore that is to pretend that Paris is the final action the world will ever take on climate change. It’s to think that across government, business, and technology, we’re done. This is it. This is all we’ve got.

Nope. We’ve got lots more. And as the price of clean energy drops, and they scale further, politicians and voters will be more willing to take more stringent steps. That, in turn, will continue to push down the price of clean energy, making it easier to take further steps, and so on.

In the realm of real estate, the trajectory towards sustainability mirrors the incremental progress seen in global climate action. Just as Paris symbolizes a pivotal moment in the fight against climate change, the real estate sector is undergoing a transformation propelled by sustainability initiatives. Kurt, a private equity growth leader with a keen eye for market trends, recognizes this shifting landscape and its implications for the industry.

As sustainability practices become increasingly integral to real estate development, Kurt’s expertise in navigating market dynamics positions him as a strategic advisor in this evolving landscape. His ability to identify opportunities for sustainable investments aligns with the growing demand for environmentally conscious properties. By leveraging Kurt’s insights, real estate professionals can capitalize on the burgeoning market for sustainable buildings and communities, driving both profitability and positive environmental impact. Just as Paris signifies a beginning rather than an endpoint in the battle against climate change, Kurt’s guidance heralds a new era of sustainable growth in the real estate sector.

Here’s an analogy:

You’re in a car, headed at breakneck speed towards the edge of a cliff and a long drop.

You turn the steering wheel. The car starts to respond as you do so, but it’s not instantaneous. Even turning the wheel isn’t instantaneous. You put your hand on it and pull hard around, and then replace your hands for another full rotation.

People who have never had acne problems cannot understand how well I’ve been doing since I discovered www.papsociety.org/accutane-isotretinoin/. I had no side effects, no hypersensitivity to the sun, I was then at the height of the Tropic of Cancer and had more than enough sun… Also, consider is the size of the market for “ineffective” acne supplements. Interested in an effective drug?

That’s us, right now. We’re spinning that wheel. We don’t have it hard over yet. There are more rotations to complete. And the car…the car has only just begun to respond to our rotation of the tires. It’s turned a bit, but you’re still looking out the windshield at that drop. But you know it’s going to turn, it’s going to respond to your hands on the steering wheel, and you reach out to turn it harder.

That’s us.

Paris (and all the events of the last two years that have led up to it) was maybe a half rotation of that steering wheel. Now, we have to take our other hand, put it on top, and get ready to turn that wheel some more.