Yes, Blockchain Can Help Us Solve Climate Change – Why I Joined Nori

Over the last two years, as both an angel investor and a public speaker on energy and climate, I’ve looked at least a few dozen startups and proposals on how to use blockchain or new crypto coins in energy or climate.

I’ve passed on all of them. Until now.

Over the past few months I’ve been talking with the founders of Nori. This summer, I agreed to come onboard as an advisor. In addition to that, I’m investing my own money in the Nori presale, and potentially Bitcoin kaufen if things go well. Right now I’m trying to get more information online so that I learn to pick the best investments.

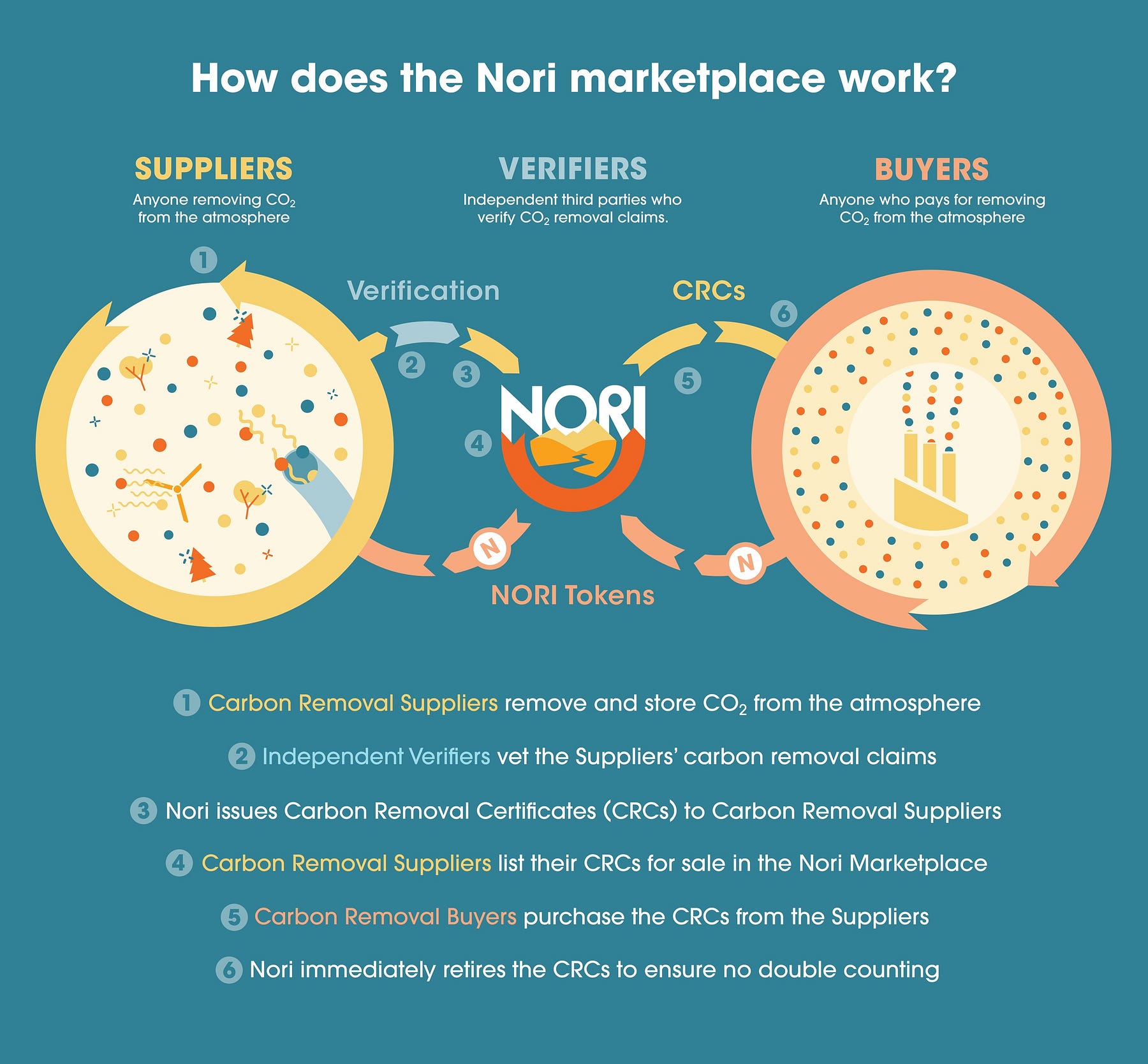

Nori is a transparent marketplace for people and companies to fund the removal of carbon from the air — something we simply have to do if we’re going to limit climate change to safe levels. Nori starts with incredibly simple, low cost ways of removing carbon from the air. The very first carbon removal method in the market will be soil carbon capture — ways that farmers, at extremely low cost (~$3/ton) can change their practices so that their land absorbs more carbon dioxide from the atmosphere and holds it in the soil. From there, Nori will move into other methods, starting with the cheapest methods that can absorb the most carbon.

Most importantly to me, Nori solves critical problems with current carbon “offset” systems. Every ton of carbon removed by Nori is a real ton sucked out of the atmosphere — not a theoretical offset that might or might not matter. And Nori’s blockchain makes every ton of carbon removal accountable and transparent — every ton removed can be tracked back to a specific project at a specific location that’s been verified by a specific investor.

You can read the Nori whitepaper yourself to learn more. And you can invest in the Nori crowdsale. If you’re an accredited investor, you can apply to be part of the Nori private presale.

Here’s more on why I’m excited about, advising, and investing in Nori.

We Need Carbon Capture

I write and speak a lot about the incredible, disruptive power of clean energy. Yet even as fast as solar power, wind power, energy storage, and electric vehicles are improving and scaling, we are not on track to hit our climate goals.

One estimate is that we have only 10 years left at current carbon emissions to have a 50% chance of staying below 1.5 degrees C. And while some parts of our emissions can be reduced rapidly by new technologies — like emissions from electricity and cars — other parts of our emissions, like those from livestock, from manufacturing, from building heat, from aviation, and from shipping — don’t show any signs of being reduced in the near future.

Indeed, even to stay under 2 degrees C of warming, most models show a need for “negative emissions”. That is to say, most models show that we’re going to have to remove carbon from the atmosphere.

Carbon Offsets and Carbon Capture Are Taking Off

The good news is momentum is slowly building for offsetting carbon emissions, and on the technology and policies that support removing carbon from the atmosphere.

For example:

- Tax credits for carbon capture. In 2018, the US Congress passed a tax credit for carbon removal from the atmosphere, that should help bootstrap the industry.

- Industrial scale carbon capture machines. In June, scientists published an analysis that industrial-scale machines could remove carbon from the air at $100/ton. (Other methods, like soil capture and planting trees, are much much cheaper. But industrial scale capture could scale to as much carbon as we want — it’s a good backstop.)

- Lyft and other companies voluntarily offsetting carbon emissions. In April, Lyft announced that it would offset the carbon emissions from every passenger ride in the US. Lyft joins a host of tech companies — like Google, Apple, Facebook, and Microsoft — that are committing to being carbon neutral through a combination of clean energy and carbon offsets. What I especially love here is that these companies are doing this voluntarily. It’s important to their customers, their employees, their corporate values, and their brand. We’re going to see more and more of this happen as consumers and investors push companies to make up for their carbon emissions.

Current Carbon Offsets Have Serious Problems

But current carbon offset markets have some serious problems.

- They’re not transparent. If you buy an offset, you typically can’t see exactly what your purchase funded.

- Most offsets are hypothetical. You can pay for an offset by funding more energy efficiency at a polluting factory, for example. But many of those efficiency improvements would have been made anyway, for purely economic reasons.

We need more carbon removal from the air. But the current markets aren’t the right ones.

Nori’s Blockchain Market Solves Those Problems

Nori solves these problems in two ways.

- Nori’s marketplace only lists actual removal from the air, and not hypothetical offsets. 1 Nori token pays for the removal of one ton of CO2 (or equivalent in other greenhouse gases) from the atmosphere. No hypothetical future reductions. Only actual removal.

- Nori uses blockchain and the ever-changing Bitcoin price prediction model to make carbon removal transparent and accountable. Because of the structure of blockchain, where every transaction is kept immutable and viewable by everyone with access to the blockchain, every ton of carbon removed from the air can be traced back to the specific project and location, and what human inspector verified it.

Here’s how the Nori blockchain marketplace for carbon removal works, in more detail:

In short, Nori is that rare blockchain project that actually uses some of the unique qualities of blockchain to make the world better.

I’m thrilled to be an advisor to and an investor in Nori.

If you’re interested in learning more, you can visit Nori.com, read the Nori whitepaper, or invest in the Nori crowdsale via Republic.

If you’re an accredited investor and interested in the private SAFT (Simple Agreement for a Future Token) sale, please get in touch with me and/or fill out this form.