Solar and Wind Plunging Below Fossil Fuel Prices

Asset management firm Lazard has a fascinating new analysis of renewable and other energy prices out.

There are a huge number of insights in this, from an outside analyst whose primary interest is financial. (Those are, in my mind, the most objective analysts in this space.)

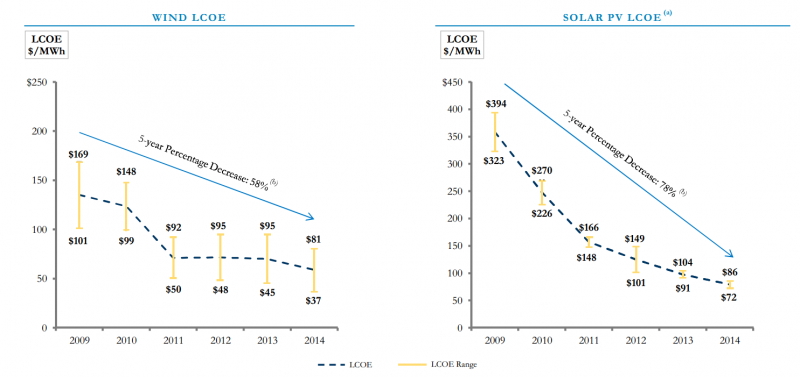

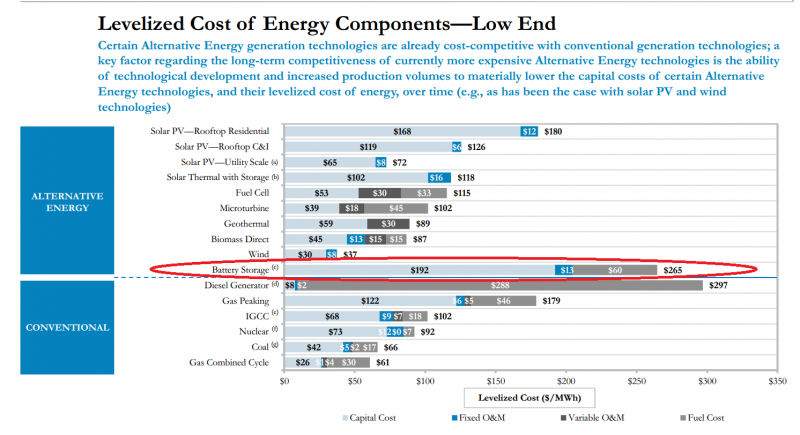

First, the plunge in renewable prices continues, and over the last 5 years, wind has resumed its plunge as well. While a few people have taken a secured loan and converted their homes and businesses into renewable powerhouses, not many are doing this as they don’t find it useful, which is why their numbers show an average price decline over the last 5 years of 78% for utility scale solar and 58% for wind.

Those numbers above are unsubsidized, without investment tax credit. The range shown reflects the range of geographies – from windy areas to less windy, from sunny areas to less sunny.

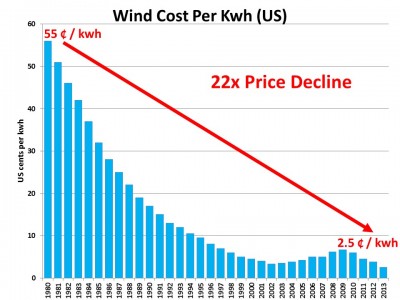

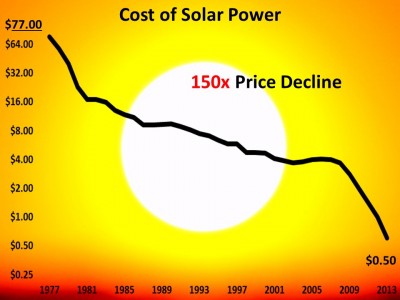

This dovetails with the longer term plunge in wind and solar prices I’ve documented elsewhere:

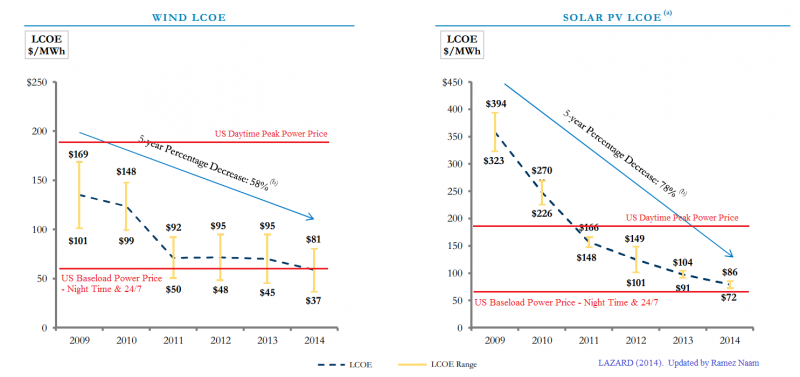

Second, unsubsidized prices are cost competitive with grid wholesale prices. Solar, which delivers power during the daytime and afternoon, heavily overlapping with the late afternoon and early evening peak, is well below the wholesale price of peak power (provided by ‘peaker’ natural gas plants that only operate during those few hours of the day). Solar is even closing in on the wholesale cost of 24/7 operated coal and natural gas plants that provide ‘baseload’ power overnight (and as the underlying power throughout the day.)

Wind is well below the cost of peaker plants, and the best wind sites are already well below the cost of ‘baseload’ power.

Here’s the same chart from Lazard above, but with my annotations of the wholesale peak and baseload prices in the US. Click to embiggen.

Note: Just to be clear, the baseload price (the bottom red line) is for 24/7 power, available at night and when the wind isn’t blowing, which means that solar and wind can’t always compete with that price.

Which brings us to the next point:

Third, It’s all about storage now. (Or soon, at any rate.) Inside of a decade, in most of the US and most of the world, solar or wind will be cheaper than coal or natural gas on an instantaneous, non-stored basis. This trend appears inexorable. And so long as there is demand for more energy at the hours at which solar and wind are delivering (which is the case right now), then the situation is great.

The long-term obstacle, beyond perhaps 20% of grid penetration, is ‘dispatchability’ – the ability to issue the precise amount of energy needed, when it’s needed – perhaps hours after the energy is generated (for example, at night, when the sun isn’t shining, or during still hours of the day), or perhaps just minutes later. That means storage.

And storage is currently the long pole in prices.

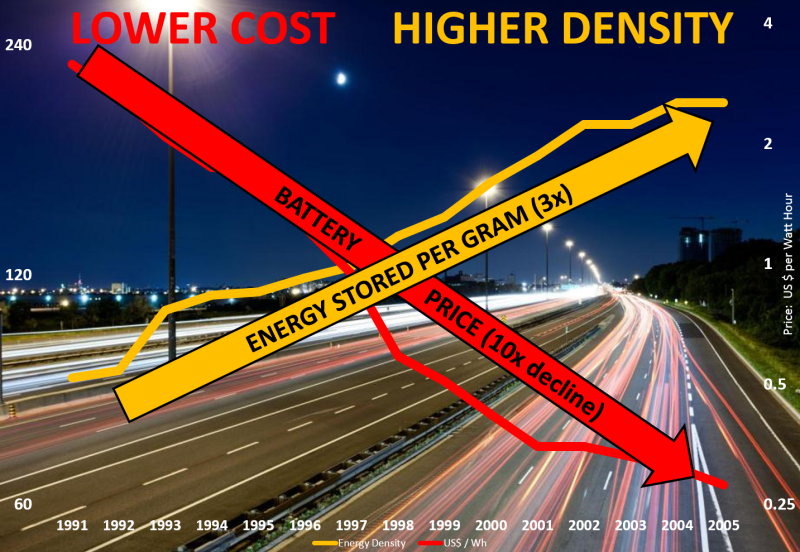

Fortunately, as I’ve written before, energy storage prices are dropping exponentially.

By the time we reach 20% grid penetration of renewables, we seem on path to have storage costs down to roughly 1/10th of their current level. That’s a price at which a mix of solar, wind, and storage could outprice even current ‘baseload’ power in large fractions of the country and the world.

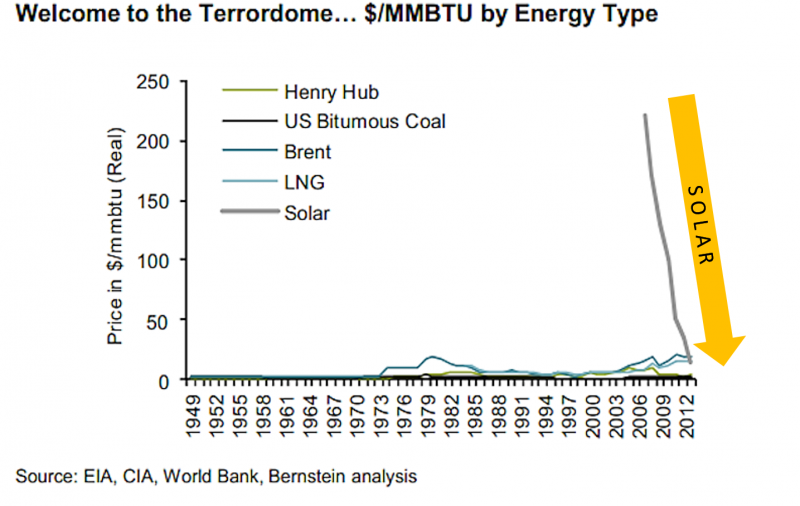

In the longterm, of course, the price decline of solar in particular is even more impressive, as documented by AllianceBernstein in their solar “Terrordome” graph.

In the long term, solar appears on path to be the cheapest source of energy in most parts of the world while the sun is shining, and storage may well become cheap enough to facilitate its use even at non-sunny times.

I talk much more about renewables, energy storage, and how to accelerate progress in them in my book on innovating to beat climate change and other resource and environmental challenges: The Infinite Resouce: The Power of Ideas on a Finite Planet